New Revenue from New Products and New Markets

In my last blog, we outlined how companies can gain more Business-to-consumer (B2C) and business-to-business (B2B) revenue from a more responsible company brand. This week we will look at a second way that sustainability strategies bolster revenue: the green attributes of the company’s products and services become differentiators.

The payoff for differentiation is increased market share as customers who seek “green” solutions are attracted to the company’s products and services over its competitors’. That is, the sustainability attributes of a company’s products are differentiators to B2C and B2B customers who seek “green” solutions.

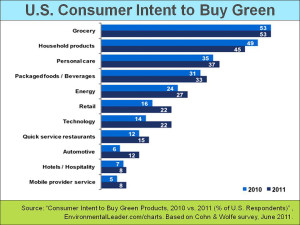

The adjacent slide and the one below show the consumer demand for green products is still strong, although surveys indicate that consumers will not pay much extra for green products. However, by applying creative approaches to manufacturing and design, environmentally friendlier products need not be more expensive or lower in quality.

When green and non-green products achieve price equity, there is evidence that consumers choose the greener one.

There are parallel B2B revenue opportunities. GE is the classic example of a company determined to dominate the B2B market for green products. As explained by GE’s ecomagination 2009 annual report, the ecomagination portfolio of products and services, which includes “green” appliances, aviation, energy, healthcare, lighting, oil and gas, transportation, and water products, grew from 15 in 2005 to over 90 by 2009.

When GE first launched its ecomagination thrust in 2005, it quickly generated 6.4% of the company’s sales — $10.1 billion toward GE’s overall revenue of $157.2 billion in 2005. Four years later, GE’s ecomagination revenues had grown to $18 billion, even in a challenging global environment, and accounted for about 10% of GE’s revenue. In 2011, GE pledged that ecomagination revenue will grow at twice the rate of total company revenue between 2010 and 2015, making ecomagination an even larger proportion of total company sales.

Siemens has a similar aggressive green product strategy. Its environmental portfolio includes products used in renewable energy; power transmission and distribution; green solutions for transportation; building technologies; lighting; environmental technologies; and healthcare. In fiscal year 2010, Siemens’ environmental portfolio accounted for around €28 billion, or 37%, of the company’s total revenue of €76 billion.

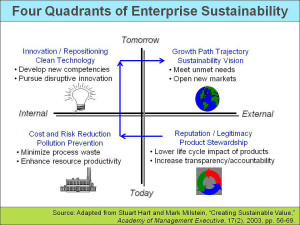

Siemens and GE want to be the go-to companies for green products in their market sectors. Companies like them “creatively destruct” their own product lines as shown in the upper left-hand quadrant of the adjacent slide, to develop innovative new green products before their competitors do. Then they take them to market in the upper right-hand quadrant, tapping into exciting new growth markets.

In my previous blog and this one, we have looked at two ways in which sustainability strategies can the top line: they can make the company’s brand more attractive in its B2C and B2B markets, and they can open up new revenue opportunities from new products and new markets. In my next blog, we’ll look at a third sustainability-enabled revenue stream.

As usual, the above slide are from my Master Slide Set.

Please feel free to add your comments and questions using the Comment link below. For email subscribers, please click here to visit my site and provide feedback.

Bob

Comments are closed.