Hazel Henderson’s 7 Reforms of the Global Financial System

Sometimes people ask me which industry sectors contain the “high-impact” companies. That is, which industry sectors include companies whose operations pose the biggest threats to sustainability? In the past, my answer was the oil and gas, mining, power-generation, forestry, and chemical sectors. They continue to be challenged to mitigate their environmental and social impacts. Lately, their ranks have been joined by new sectors.

Communications, information technology, services, and financial sectors are usually described as being “clean.” They don’t pollute, at least not directly, so they were under the radar screen of most sustainability champions. Things change. The economic leg of the three-legged sustainability stool has taken a severe hit and it hasn’t been from the traditional “high-impact” sectors. It’s been an inside job. The behavior of some actors in the financial sector is now looming as a very significant threat to the stability of the whole sustainability stool. Once-revered financial institutions have morphed from being innocently “clean” to being dangerously “high-impact.” The sub-prime mortgage crisis blew their cover.

To view the following video in full screen, click on the arrows in the bottom right corner of the video. If you are receiving this blog post via email, click on the title of the video to view it.

Subprime Crisis Explanation (8:50 minutes)This is an excellent satirical explanation of the origins of the subprime mortgage crisis by British comedians John Bird and John Fortune. They jab at the fancy names given to packages of “dodgy debt” to make them more attractive to investors, labels like “High-Grade Structured Credit Enhanced Leverage Fund.” They spoof rewarding “greed and stupidity” by bailing out investment houses whose “sophistication,” “rigorous analysis,” and “ingenuity” precipitated the economic collapse.

They explain how the incentive system in the chain of financial transactions and the devious re-packaging of the original debt helped made brokers rich and diffused accountability. The unfettered financial system failed us.

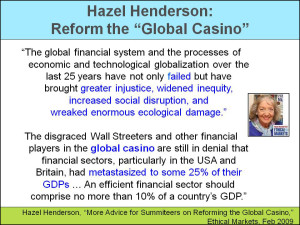

Was the financial crisis triggered by a unique combination of unusual circumstances, or was it the inevitable outcome of a decaying system? Noted futurist, author, and ecological economist, Hazel Henderson, declares that Wall Street has degenerated into a global casino, with a far too dominant influence on the global economy. She says it must be rehabilitated and suggests seven reforms that would be a good start.

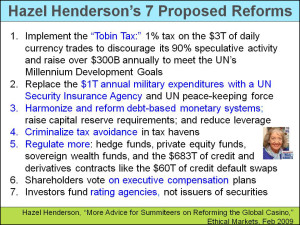

In the run-up to the 2008 G-20 Washington Summit on Financial Markets and the World Economy, Hazel wrote “Advice for Summiteers on Reforming the Global Economy” for Ethical Markets. The highlights of her article are summarized in the adjacent slide. She 1) discourages speculative trading with a 1% Tobin Tax; 2) reallocates government military spending to international forces; 3) restructures monetary systems; 4) criminalizes tax havens; 5) regulates derivatives and other dubious financial instruments; 6) reins in executive compensation; and 7) reduces the influence of investment houses on rating agencies.

What impresses me is the pervasiveness of her recommendations, which go right to the heart of several systemic problems in our current economic system. Unfortunately, the political courage to enact these reforms is lacking. Nevertheless, her checklist of reforms provides us with clues to look for as we assess the effectiveness of the changes that are endorsed by politicians and regulators.

Bob

Comments are closed.