Michael Moore’s 10-Point Recovery Plan

I recently saw the new movie, “Inside Job.” It is a shocking documentary about the $20 trillion global financial meltdown in 2008. As movie reviewers Mary and Richard Corliss said in TIME magazine, “If you are not outraged by the end of this movie, you weren’t paying attention.”

I was. It was not an accident that millions of people lost jobs and their life savings. It was a premeditated plan by financial system insiders to defraud trusting outsiders.

What is doubly upsetting is that the same people who got us into this mess are the ones charged with getting us out of it. The foxes are still in charge of our hen house. The blatant excesses in the banking and brokerage corporations are continuing unabated, supported by government “economic stimulus.” Throwing money into the pockets of those whose greed caused the collapse is called “Quantitative Easing.”

To view the following video in full screen, click on the arrows in the bottom right corner of the video. If you are receiving this blog post via email, click on the title of the video to view it.

Quantitative Easing Explained (6:48 minutes)Ever wonder what “quantitative easing,” “the Fed,” and “deflation” mean. Ever wonder about Ben Bernanke’s qualifications to be Chairman of the United States Federal Reserve and how Goldman Sacks benefits from its close relationship with the Fed? Check out this clever little video. As with any humor, the cartoon characters’ explanations are over-simplified for effect. They get away with them because they are cartoon characters—the same reason that court jesters got away with speaking truth to power in royal courts.

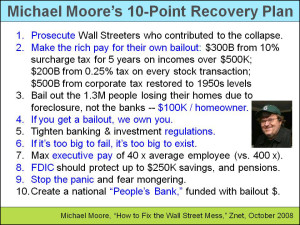

“Inside Job” could have been a Michael Moore film. The tone of Matt Damon’s narration, the script, the interviews, the titles, and the flow of events are very similar to his trademark style. It seems appropriate, therefore, to ask what Michael’s prescription would be to correct the immediate and longer term ills of a sick financial system. As shown in the adjacent slide, he doesn’t shy away from some very direct recommendations.

In any crisis, it’s easy to blame others for allowing it to happen. The accused understandably push back and encourage their critics to put up or shut up—to suggest options that should have been taken or ways to avoid a recurrence of the disaster. These days, that’s a risky tactic. Smart people are rethinking the fundamental purposes and governance of our financial institutions. It will be interesting to see how long the status quo can survive the onslaught of enlightened alternatives.

Bob

Comments are closed.