Aligning ESG Benefits with the Standard 2-Part Business Case

There are only two reasons a company changes: to avoid risks and / or to capture opportunities. They go for the upside, and / or run from the downside. They are attracted to the carrot, and / or want to duck the stick; the yin and / or the yang. Trying to convince a company to fully embed sustainability into its strategies and operations requires a very compelling business case. The standard business case is made up of these same two parts, shown in the figure below.

The status quo is very difficult to change. A company’s carefully crafted strategies, operational processes, current product lines, and organizational culture have served it well. There have to be very good reasons to mess with success, or the proposal will fail. Sustainability champions need to show what the company will gain if it embraces sustainability-related strategies, and the threats to the company if it does not.

We like to think that the appeal of new opportunities will be adequate to convince companies to embrace smart sustainability strategies. We size potential benefits, show how they contribute to a more robust bottom line, and wonder why companies don’t leap at the chance to be more profitable. My research has shown that typical small companies can improve their profits by at least 66% within five years by embracing smart sustainability strategies; for typical large companies, that potential profit improvement is 38%. It looks like embracing sustainability opportunities is a no-brainer.

Unfortunately, a company has to change how it does things – it has to innovate – in order to reap the sustainability benefits, and the status quo needs a wake-up call. That’s where the risk of not changing is a helpful, essential part of the business case. The burning-platform theory of change says that things need to get hot before we decide to jump into new waters. The downside of not changing is often more motivating than the upside of doing things differently. The fear factor normally trumps the hope factor.

Later on, when leaders explain why they are doing the right things now, they often deconstruct the drivers and emphasize the opportunities that they wanted to capture by instituting new environmental, social, and governance (ESG) strategies and procedures. The risks that they wanted to avoid are often unspoken, but they were usually critical motivators. As sustainability champions, we need to gently help point out those threats up front and quantify their potential impact, to ensure the business case is compelling.

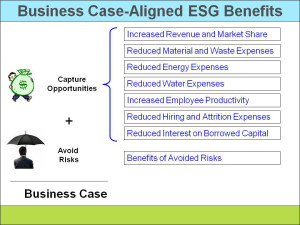

The adjacent slide aligns the seven benefits that can be reaped from smart sustainability strategies with the Capture Opportunities part of the business case. The benefits of avoiding the risks are noted against the Avoid Risks component. The risks are sized by quantifying the potential impact of the threat and factoring it by the probability of the risk occurring within the scenario planning timeframe.

Don’t let the 7:1 ratio of benefits to risks fool you. The ratio of their weighting in the decision-making process may be the reverse.

To make it easy for executives to see the relevance of sustainability-related strategies, we need to map their benefits against frameworks with which executives are already comfortable. This week, we mapped them against the standard 2-part business case that is behind all business decisions. This is the fourth of a portfolio of four frameworks that improve the relevance of the sustainability business case to business leaders. The other three were:

1. Aligning ESG Benefits with Executives’ Top 10 Priorities

2. Aligning ESG Benefits with the Income Statement

3. Aligning ESG Benefits with the Value Chain

Now we have four arrows in our quiver. Let’s go for the credibility bulls-eye!

As usual, the above slides are from my Master Slide Set.

Please feel free to add your comments and questions using the Comment link below. For email subscribers, please click here to visit my site and provide feedback.

Bob

Comments are closed.