3 Sustainable Ways to Rev-Up Revenue

A powerful rationale for sustainable development is enlightened self-interest, fed by the prospect of increased revenue, markets, and profits. Savings are good; revenue growth is exciting. Business strategy is often driven by bolstering revenue more than by cutting costs. Over time, societal expectations change. Companies should anticipate those changes and develop new practices, new products, new services, and new markets in advance. Doing this before competitors do is the key to revenue growth and to profits.

Last August, I wrote two blogs showing how sustainable enterprises handle the tricky issues of growth and over-consumption: An Elephant in the Sustainability Room: Growth and Another Elephant in the Sustainability Room: Over-Consumption. Sustainable firms disconnect revenue growth from depletion of natural resources. They drastically reduce the amount of natural resources required to make their products and they use resource- and energy-efficient manufacturing processes.

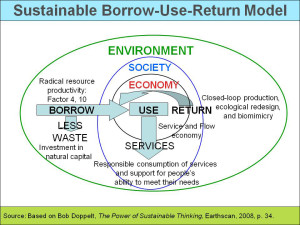

They decouple revenue growth from waste, pollution, and the depletion of natural capital — they take back their products at the end of their useful lives and ensure they are responsibly disposed of or reused, as illustrated in the adjacent slide. They treat internal and external stakeholders with respect.

We want leading sustainable companies to win. We want them to take market share away from unsustainable competitors — to take a bigger slice of the existing market pie. The payoff to a company for featuring the reduction of its product’s energy requirements and environmental impacts is improved brand image and reputation. This increased mind share is furthered by endorsements by external environmental agencies, generating beneficial “noise” around the products attributes and free publicity. That contributes more momentum to the revenue gains.

When market leaders take action, their competitors often follow suit. As soon as competitors have similar environmentally sensitive offerings, any competitive differentiation is lost. The half-life of competitive differentiation is becoming increasingly shorter as reverse engineering and corporate intelligence improves. That is why continuous innovation and generating new revenue streams are essential to sustaining a competitive advantage.

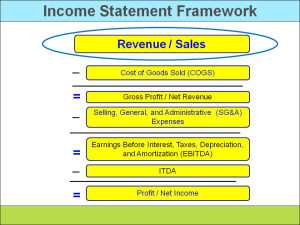

In my May 2011 blog, Aligning ESG Benefits with the Income Statement, I discussed using the Income Statement as a framework for the business case for sustainability. Following the flow of the income statement in the adjacent slide, the top-line benefit area is increased revenue and market share. In my next three blogs, we will look at how sustainability strategies contribute to three revenue streams:

- More revenue from current products and markets

- New revenue from new products and markets

- New revenue from services and leasing

As usual, the above slides are from my Master Slide Set.

Please feel free to add your comments and questions using the Comment link below. For email subscribers, please click here to visit my site and provide feedback.

Bob

Comments are closed.