The Risk to Revenue From Less Competitive Prices

There are at least seven threats to a company’s revenue stream if it fails to embrace sustainability strategies. In my last blog, we outlined five risks to revenue from a poor reputation on; 1) energy and carbon management, 2) water management, 3) materials and waste management, and 4) eco-system damages, as well as 5) the risk to revenue from poor reputations of the company’s suppliers.

This week, we’ll look at another: the risk to revenue if the company loses its competitive price advantage.

No margin, no mission. Social responsibility and sustainability include growing sufficient revenue and profitability to sustain the organization’s mission. There is nothing wrong with building enough margin into the prices of products to generate healthy profits. However, there are two ways a company could jeopardize its margin.

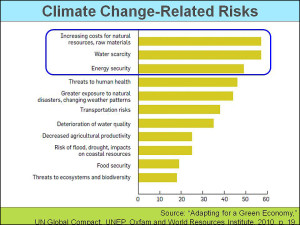

First, it is one thing to be expensive; it is another to be more expensive than competitors. The adjacent slide shows the concerns that drive companies’ climate change strategies. Pricing worries are behind the top three. If competitors are quicker to harvest the benefits of materials, energy, and water efficiencies, they could gain a price advantage and attract customers away.

Second, there is also evidence in the consumer goods retail sector that a business could be leaving margin on the table, or on its competitor’s table, if it does not invest in a good CSR reputation. In their May 24, 2011 article in Advertising Age, “Does Corporate Social Responsibility Build Customer Loyalty?” Jackie Luan and Kusum L. Ailawadi describe some interesting findings. Their 2010 study of 3,000 grocery shoppers showed that four dimensions of CSR performance positively influence consumers’ attitudes toward a retailer: environmental friendliness, treating employees fairly, community support, and sourcing from local growers and suppliers. Grocers who offer locally sourced products and who are known to pay their employees fairly earn their customers’ goodwill and loyalty If a retailer is able to improve consumers’ perception of its fair treatment of employees and its local sourcing by 20%, the amount of business from those customers increases by 1.7% and 2% respectively. These numbers appear small, but they represent a sales increase of 10% to 15% for the average retailer in the study.

The big surprise in the study was that if a retailer chose to leverage its improved CSR perception into higher prices rather than more sales, a 20% increase in customers’ perception of employee fairness “translated to a price premium of about 12%, and a similar increase in local product sourcing translates to a price premium of about 16%…Consumers do not just respond to the price charged; they also respond to how fair they think the price is. High prices are considered fairer if they can be attributed to “good” motives like covering the cost of CSR efforts rather than to “bad” motives like pure profit-taking.”

To run the numbers, let’s assume the company’s current revenue is $500 million We conservatively assume that companies not practicing good CSR could find themselves with a price disadvantage that jeopardizes 10% of their revenue, and that there is a 10% chance of this occurring. That results in $5,000,000 of the company’s revenue being in jeopardy if they decide to not embrace sustainability strategies while their competitors do.

The five reputation-based risks we looked at in our previous blog put $20,250,000 of the company’s current $500,000,000 of revenue at risk. We just added another $5,000,000 for a new total of $25,250,000.

That’s bad. It gets worse. Next week, we will look at a seventh risk to revenue and then total it all up.

As usual, the above slide is from my Master Slide Set.

Please feel free to add your comments and questions using the Comment link below. For email subscribers, please click here to visit my site and provide feedback.

Bob

Comments are closed.