5 Circularity Solutions To Achieving Net-Zero Carbon Footprints

Best-available climate science warns that we must reduce our annual greenhouse gas (GHG) emissions by 50% by 2030, and by 100% by 2050. Organizations that sign-up for these net-zero targets track their annual direct and indirect GHG emissions. Annual indirect GHG totals include the carbon footprints of products that were bought by the organization that year – that is, the GHGs that were generated throughout the supply chain during the production of those products. We need carbon footprints to be as low as possible. Ideally, they should be net-zero. That sounds like mission impossible. Maybe not. Happily, there are five circularity solutions to achieving net-zero carbon footprints in a given year.

First, let’s review carbon footprint accounting rules. They are defined by the bible of greenhouse gas measurement and management ‒ the GHG Protocol. Here is how the GHG Protocol defines the two kinds of carbon footprints.

- The carbon footprint of purchased goods and services: GHG emissions caused by the extraction, production, and transportation of goods and services purchased or acquired by the reporting company in the reporting year.

- The carbon footprint of capital goods: GHG emissions caused by the extraction, production, and transportation of capital good purchased or acquired by the reporting company in the reporting year.

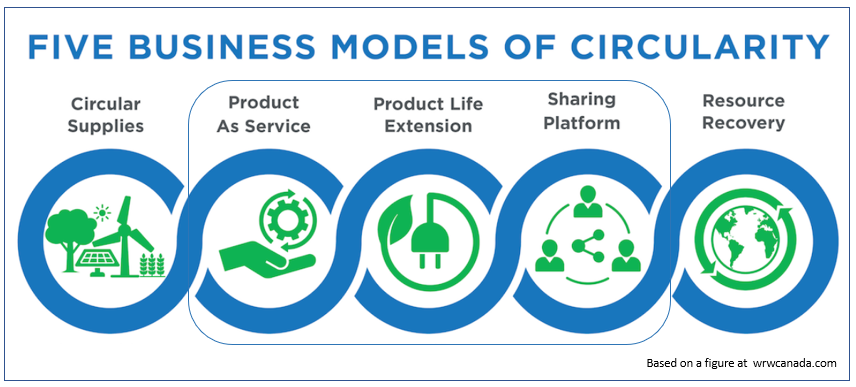

Note that the carbon footprints of products and assets are only accounted for in the year in which they are purchased. They are not carried forward on the books, nor depreciated over time. Effectively, they are written off by the purchaser in the year the product / asset is purchased. Given this context, several business models of circularity depicted in the above figure provide creative ways that a reporting company can reduce carbon footprints to net-zero in the reporting year.

- Product-as-a-Service (PaaS) – Leased or Managed Services

The GHG Protocol requires carbon footprint reporting for purchased products and assets. If they are leased, they are not purchased. The organization is still accountable for the GHGs emitted during the product’s use, but not for the embodied carbon caused by its creation.

But then, who is accountable for the carbon footprint of the leased product? Answer: The company that is offering it for lease. The lessor accounted for the leased product’s carbon footprint in the year that it purchased or acquired it. Double accounting by the lessee for the product’s carbon footprint in the year that it signs the lease is not necessary. - Product life extension: Buy a used / pre-owned product

The carbon footprint of a used / pre-owned product has already been, or should have been, accounted for by its previous owner. Its carbon footprint does not need to be accounted for again by its new owner. Double accounting by the new owner for the product’s carbon footprint is not necessary because no new, additional GHGs were generated. The life of the pre-owned product was simply extended. - Product life extension: Postpone the purchase

The product with the lowest carbon footprint is the one you don’t buy. If possible, postpone the purchase of a replacement product and keep using the current product. If necessary, extend the current product’s useful life by repairing, refurbishing, or upgrading it. The organization is accountable for any GHGs generated during those repairs and upgrades, but it has already accounted for the current product’s carbon footprint in the year that it was purchased or acquired. No new product purchased this year, no carbon footprint this year. - Sharing platform: Pay-as-you-go

If I use an electric drill only a couple of times a year, I should rent one, not buy one. When I rent it, I am not responsible for its carbon footprint. The rental company already accounted for it in the year that it purchased the drill. If an organization doesn’t require a product’s function frequently, rental or pay-as-you-go is a financially-smart and carbon-smart way to access the product’s function without being accountable for its embodied carbon in the year that it is used.

Does this mean that organizations using leased, pre-owned or rented products don’t need to consider the carbon footprints of those products? Not at all. Companies committed to net-zero targets use Net-Zero Procurement to ensure they get best value for money by procuring the most climate-friendly products from suppliers who are most committed to science-based net-zero GHG reduction targets. They ask about the carbon footprints of leased and pre-owned products and procure the ones that have the lowest carbon footprints. They are just not required to include those carbon footprints in their GHG totals for the year in which they signed the lease or purchased the pre-owned product, since no additional GHGs were generated by creating a new product from virgin materials.

The above approaches to carbon footprint accounting would accelerate our race to a decarbonized economy. The GHG Protocol Corporate Accounting and Reporting Standard provides the world’s most widely used GHG accounting standards. It is currently silent on carbon footprint calculations in the above five situations. By officially endorsing and encouraging the above circularity approaches to achieving net-zero carbon footprints in a given year, the GHG Protocol would foster symbiotic synergies that quicken our journey to a circular, decarbonized economy.

Please feel free to add your comments and questions using the “Leave a reply” comment box under the “Share this entry” social media symbols, below. For email subscribers, please click here to visit my site and provide feedback. Slides that explain net-zero procurement and overview the referenced supporting tools are included in my Master Slide Decks, to which anyone can subscribe.