4 Drivers of Carbon Footprint Reductions

My previous blog explored four ways to calculate a product’s carbon footprint / embodied carbon. Let’s suppose we do that. That is, we figure out the total product-related greenhouse gases (GHGs) emitted by all tiers of suppliers and transportation providers in the product’s cradle-to-gate supply chain. Let’s also suppose that buyers want to purchase products that have the lowest carbon footprint / embodied carbon. That is, they want their suppliers to reduce their GHG emissions that contribute to the product’s carbon footprint. There are four drivers of supplier GHG reductions that buyers can orchestrate to cause suppliers to reduce their GHG emissions, resulting in their products having lower carbon footprints.

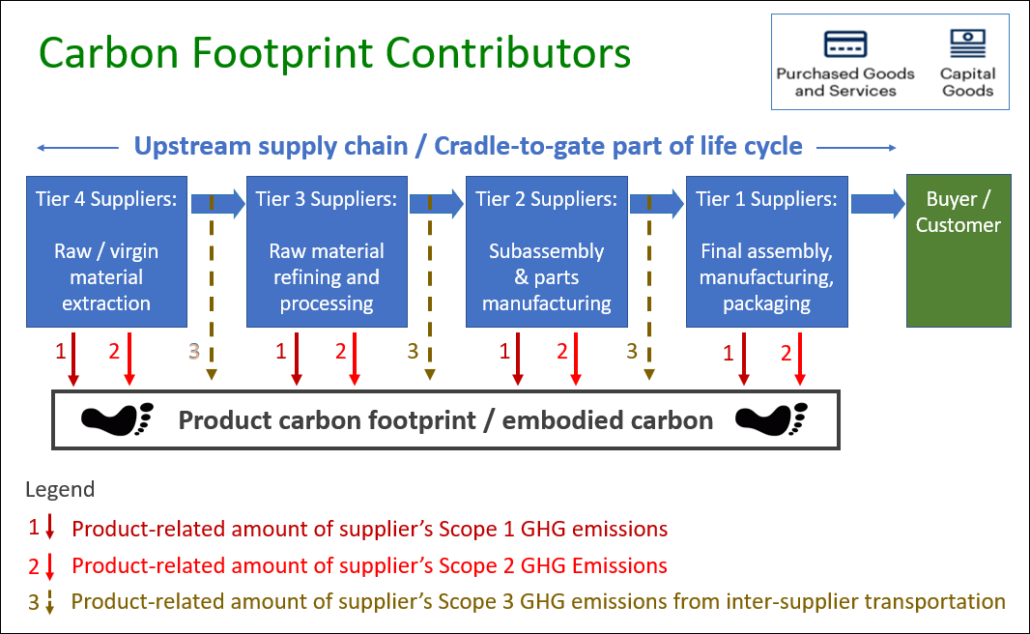

First, let’s confirm which GHG emissions that buyers want suppliers to reduce. As shown in the figure below, suppliers’ operational Scope 1 and 2 GHG emissions contribute heavily to the carbon footprints of purchased goods and services and of purchased capital goods. Supplier Scope 3 emissions that contribute directly to the product’s carbon footprint are from the choice of transportation mode between suppliers. So, those are the GHG emissions that buyers want their suppliers to reduce.

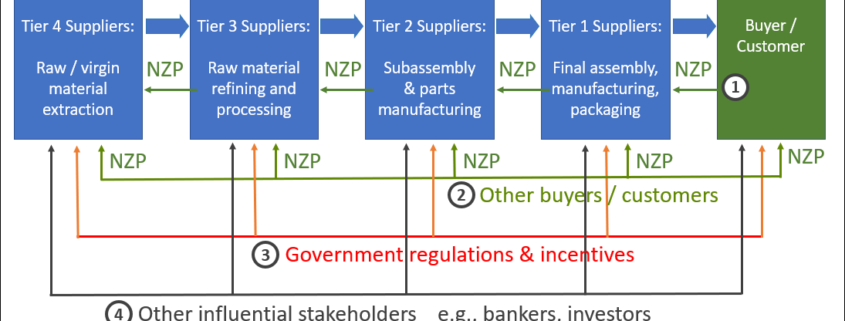

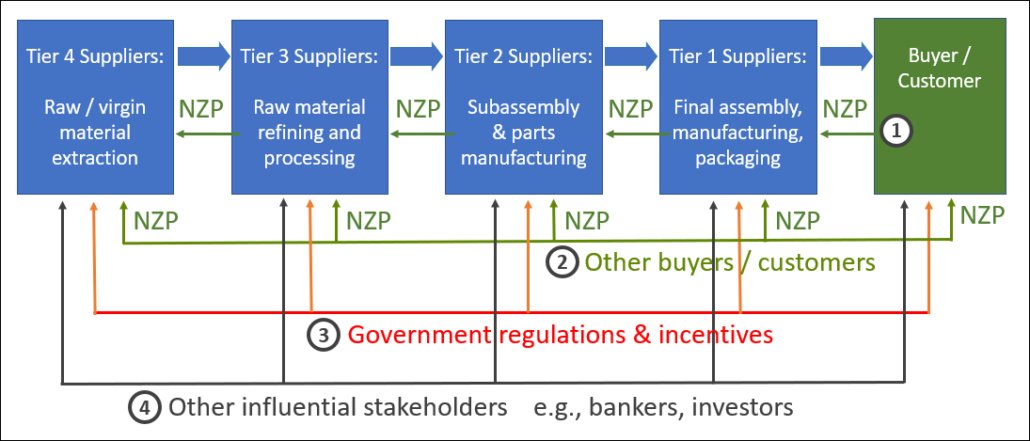

Carbon footprint analysis and calculations help identify which suppliers are the source of the greatest emissions. If there is sufficient data, artificial intelligence (AI) can help find those hot spots. AI can also help identify how changes in materials, energy sources, transportation modes, or manufacturing techniques by Tier 1, Tier 2, Tier 3 and Tier 4 suppliers could reduce the product’s carbon footprint. Let’s suppose we figure all that out. Now, the challenge is to directly and indirectly influence / motivate suppliers to actually reduce their Scope 1 and 2 emissions and to use low-carbon modes of transportation. As shown in the opening figure, above, there are four market forces that buyers can utilize to push suppliers to do that.

1. Use of Net-Zero Procurement (NZP) by the buyer

The most direct pressure by the buyer is to use Net-Zero Procurement (NZP). It ensures that buyers obtain the best value for money when purchasing the most climate-friendly goods and services from suppliers who are most committed to science-based net-zero targets. Heavy weightings in the bid appraisal make product climate-friendly attributes – such as the product’s carbon footprint – and supplier commitment to science-based net-zero targets, matter. This is the signature feature of a Net-Zero Procurement system.

Let’s assume that the buyer has a questionnaire, such as the Net-Zero Assessment Tool (NZAT), that scores how committed the supplier is to net-zero targets. In an NZP system, the bid appraisal template allocates heavy weight (i.e., 10%-30% of the points) to product carbon footprints and to supplier net-zero scores. That weighting incentivizes suppliers to improve those scores so that they at least earn more points in the buyer’s bid appraisal than their competitors. The power of the procurement purse is a powerful motivator of supplier GHG reductions, especially by Tier 1 suppliers. They want the revenuethat goes to the winning bidder.

Further, buyers usually foster good relationships with their Tier 1 suppliers. Buyers may have expertise, technology, bulk buying discounts, or connections that can help their Tier 1 suppliers improve their scores on GHG reductions. If buyers partner with their suppliers to reduce suppliers’ Scope 1 and 2 GHGs, suppliers save costs / expenses of doing it on their own.

Tier 1 suppliers might not be comfortable having their buyers directly help Tier 2 suppliers. However, Tier 1 suppliers earn bonus points in their NZAT score if they use NZP with their suppliers. Their Tier 1 suppliers are the buyer’s Tier 2 suppliers. If they wish, Tier 1 suppliers can pass some of their buyer’s assistance on to their suppliers. And so on, down the supply chain. So, there is a ripple effect in the supply chain of earning revenue and saving expenses by reducing GHGs when NZP is used by all tiers of suppliers.

2. Use of NZP by other buyers

Tier 4, Tier 3, Tier 2, Tier 1, and even buyers themselves are Tier 1 suppliers to other buyers / customers, as shown in the opening figure. As NZP becomes the new normal, the above dynamics will be echoed as multiple buyers heavily weight their Tier 1 suppliers’ commitments to science-based net-zero targets and partner with them to improve their scores.

Governments are big buyers. Public procurement expenditures in the 27 democratic countries in the Organization for Economic Cooperation and Development (OECD) account for 12% of their GDP. Governments in the UK, the USA, and Canada already require their large suppliers to disclose their commitment to science-based net-zero targets. As NZP use by public and private sector buyers becomes the new normal, the above revenue and expense saving motivations will kick in. Suppliers will want to reduce their GHG emissions, resulting in lower product carbon footprints.

3. Government regulations and incentives

Some jurisdictions have a price on carbon. For example, the Government of Canada established a national price on carbon pollution starting at $20 per tonne of GHGs in 2019. In 2023, the price per tonne is $65. By 2030, it will rise to $170. That cost may be significant enough to incent companies to reduce their GHGs to save money. Their product’s resulting lower carbon footprint will be a byproduct of that action.

Also, concern about climate change is causing governments in some jurisdictions to demand that companies disclose their net-zero performance and plans. For example, the European Union just approved a Corporate Sustainability Due Diligence Directive (CSDDD). It applies initially to companies with more than 500 employees and more than €150 million in revenues. In two years, it will also apply to companies with over 250 employees, and over €40 million in revenues. It also applies to non-EU companies with annual revenues earned in the EU above those two revenue thresholds.

The CSDDD has procurement teeth. It requires companies to integrate due diligence into policies, identify actual or potential adverse human rights and environmental impacts, and end or minimize actual impacts in company operations, subsidiaries and value chains. In particular, companies must implement climate transition plans aligned with the Paris Agreement objective to limit global warming to 1.5°C, encompassing Scope 1, 2 and 3 emissions. There are sanctions for non-compliance with the directive, such as the company’s goods being taken off the market, fines as high as 5% of the company’s global revenues, or – for non-EU companies – bans from public procurement in the EU.

Companies will want to reduce their GHG emissions to comply with the CSDDD regulation and avoid the sanctions. Their product’s resulting lower product carbon footprint is a happy co-benefit.

4. Pressure from other influential stakeholders

Access to capital is important to companies. The Task Force on Climate Related Financial Disclosure (TCFD) recommends voluntary climate-related financial disclosures that provide decision-useful information to lenders and investors. Why? So lenders and investors can evaluate their clients’ climate-related risks and exposures over the short, medium, and long-term. Over 3,900 lending organizations have pledged their support for the TCFD. If providers of capital think company climate-related metrics and targets are important, they’re important. To ensure that they remain attractive to lenders and investors, companies will need to disclose how they are taking action to reduce their Scope 1, 2, and 3 GHGs. Their product’s ensuing lower carbon footprint is a collateral benefit.

The Securities Exchange Commission (SEC) has published a proposed rule to enhance and standardize climate-related disclosures by companies listed on American stock exchanges. Their disclosure requirement will align with the TCFD framework. Ditto for the Canadian Securities Administrators (CSA) for companies listed on Canadian stock exchanges. Environmental Social and Governance (ESG) ratings used by the investment community are heavily weighted to company climate-related risks and opportunities. Companies will want to reassure banks, stock exchanges and investors that they are reducing their GHGs and transitioning to renewable energy. Reducing their GHGs reduces their contribution to their products’ carbon footprints.

Companies that are serious about reducing the carbon footprints of products that they purchase will exploit all four drivers. They will use Net-Zero Procurement and encourage other companies to follow their lead. This taps into the desire of supplier companies to win bids and grow their revenue. That’s the opportunity-capture side of the motivation equation. Companies can also support and encourage governments to put a price on carbon and enact CSDDD-like regulations. These regulatory measures unleash the risk-avoidance motivation of suppliers. Suppliers in those jurisdictions will reduce their GHG emissions to avoid paying expensive carbon taxes and avoid sanctions that would choke their revenue streams. Finally, companies can support stock exchanges requiring TCFD-like climate-related disclosures from publicly listed suppliers. The resulting efforts by listed suppliers to reduce their GHGs will result in their products having lower carbon footprints.

Different reasons to reduce GHG emissions; same lower carbon footprint result. Whatever works.

Please feel free to add your comments and questions using the “Leave a reply” comment box under the “Share this entry” social media symbols, below. For email subscribers, please click here to visit my site and provide feedback. Slides that explain net-zero procurement and overview the referenced supporting tools are included in my Master Slide Decks, to which anyone can subscribe.