Purpose Drives Governance; Governance Drives Everything

(Note: Some content is based on the Multi-stakeholder Purpose section of my “The 21st Century Sustainable Enterprise Force Field” white paper.)

I was recently asked why the score on Governance was factored into other scores in the Basic Sustainability Assessment Tool (BSAT). That question prompted my adding an appropriate explanation to BSAT and tweaking the degree to which the Governance score consistently impacts scores on other sustainability issues, scores on the Sustainable Development Goals (SDGs), and scores on the three non-financial capitals (natural, human, and social capitals). Fundamentally, the importance of governance is based on the adage, “Purpose drives governance; governance drives everything.” Purpose provides the why; governance provides the how. It’s a ripple effect. Let’s explore that symbiotic relationship, starting with purpose.

A corporate shareholder-primacy purpose has worked well for decades … for the 1 percent that reaped its rewards. It failed for the other 99 percent of us. The immoral and growing gap between the haves and have-nots has exposed the myth of trickle-down economics. The 2008 financial crisis revealed the perils of short-termism and a myopic focus on shareholders at the expense of other stakeholders. Meanwhile, in the court of public opinion, companies are now being held accountable for environmental, social and economic damage.

This has led to calls for a multi-stakeholder corporate purpose. A growing consensus of business leaders, economists, academics, NGOs, and policymakers have embraced multi-stakeholder capitalism as the key to sustainable, broad-based prosperity and economic justice. They advocate for stakeholder-centric capitalism in which corporations are required to contribute to the common good, as was originally intended when corporate chartering laws were first enacted in Europe over 400 years ago.

Business Roundtable (BRT) members are CEOs of the largest 181 corporations in the U.S.A. In August 2019, the BRT acknowledged that 20th century shareholder-primacy capitalism has failed and declared that the 21st century corporate purpose is to maximize stakeholder wellbeing. The 2019 statement released by the BRT lists the six primary stakeholders to which corporations should deliver value: customers, employees, suppliers, communities, the environment … and shareholders. Shareholders are still stakeholders, but not the only stakeholder.

A corporate purpose of “maximize stakeholder wellbeing” is replacing the outdated and myopic “maximize shareholder wealth” purpose. In 2018, Larry Fink, Chairman and CEO of Blackrock – the largest investment management firm on the planet – declared it’s time that companies have a social purpose. “Without a sense of purpose, no company, either public or private, can achieve its full potential. It will ultimately lose the license to operate from key stakeholders.” In 2019, Larry Fink went further and stated that social purpose is not a sacrifice; in fact, it’s the “animating force” for profits. A 2020 survey of 150 American business executives found that over 90 percent of those surveyed believe that purpose-driven companies have positive business outcomes: improved reputation, stronger employee recruitment and retention, increased consumer trust and increased customer loyalty.

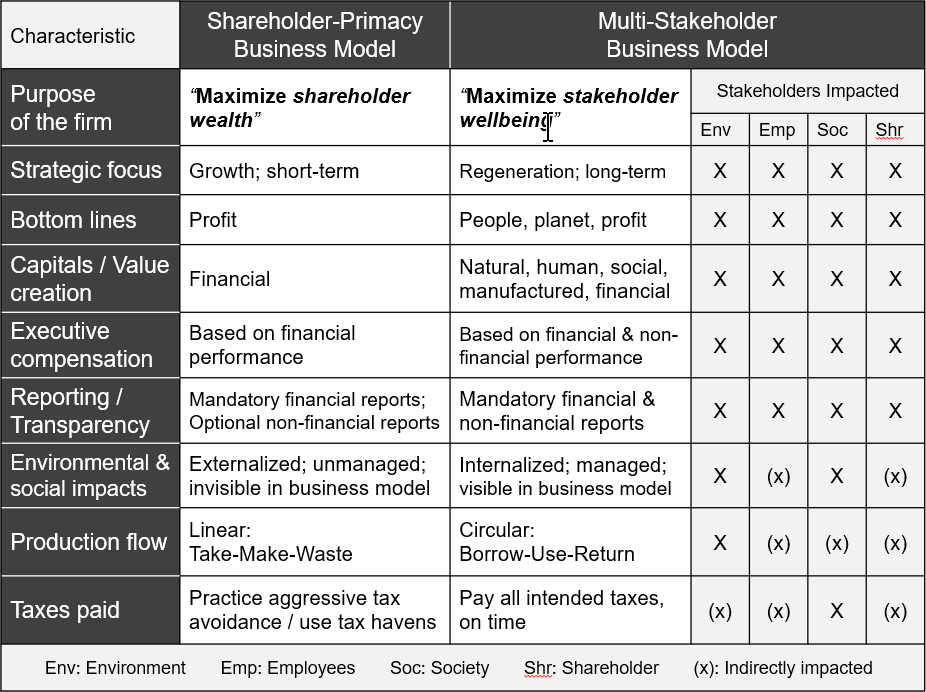

A social / multi-stakeholder purpose transforms corporate governance, which changes everything. It ensures that the board’s duty of care includes consideration for the interests of all stakeholders, including the environment / Mother Nature and society / Future Generations. It changes what the company manages, measures, rewards and discloses. It changes the definition of “materiality” from considerations that might influence an investor’s decision to broader considerations that might affect any stakeholder’s wellbeing, including the wellbeing of the environment and society-at-large. Governance aspects of a company with a stakeholder-primacy purpose are contrasted with characteristics of a company with a multi-stakeholder purpose in this figure from “The 21st Century Sustainable Enterprise Force Field” white paper.

The characteristic factors in the first column of the table are assessed in the Governance question in BSAT. The Governance score is then factored into the overall sustainability score so that it constitutes 10% of the overall score. This ensures that high scores on environmental, employee and community issues are not just a flash in the pan, or a happy fluke. Sustainability scores’ dependence on a high Governance score ensures that good sustainability scores were intentional and the result of systemic attention to sustainability issues because they matter.

A multi-stakeholder purpose improves governance. Improving Governance is the highest leverage way to improve company performance on all sustainability issues. BSAT scoring encourages that attention.

Please feel free to add your comments and questions using the “Leave a reply” comment box under the “Share this entry” social media symbols, below. For email subscribers, please click here to visit my site and provide feedback.