21st Century 5+3 Forces Model

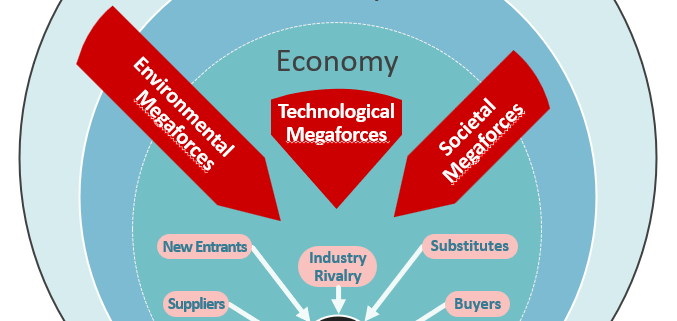

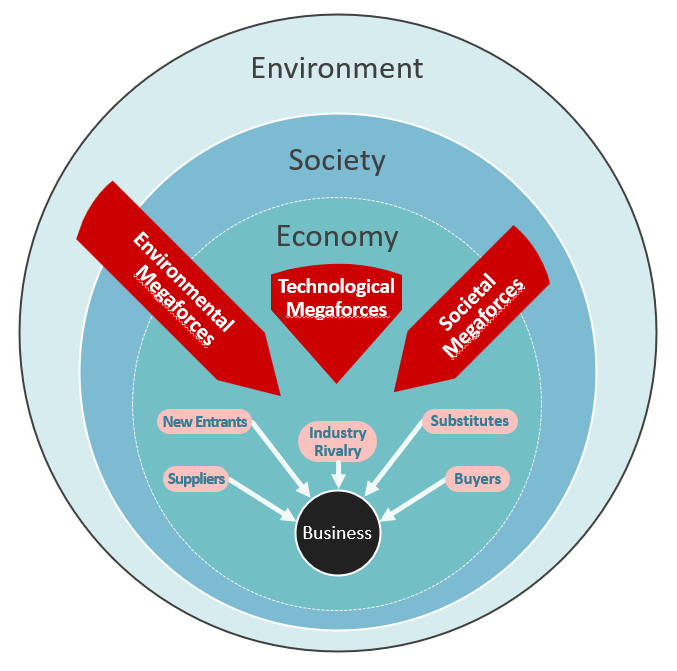

Most executives learned about Michael Porter’s famous 5 Forces Model in business school. It is widely regarded as the standard reference for strategic planning. It’s good, but it is dangerously out of date. We need a 21st Century 5+3 Forces Model.

In 1970, Milton Friedman famously declared that “the business of business is business.” A company’s only social responsibility was to increase profits. A few years later, in 1979, Michael Porter published his 5 Forces Model. It was intended to help companies increase their profitability by creating appropriate strategic responses to five competition-related forces:

- Powerful suppliers whose monopolistic position allows them to demand premium prices for their goods and services (e.g., Intel’s dominance as a chip supplier)

- Major customers / buyers demanding lower prices than your cheaper competitors

(e.g., Walmart’s relentless drive for better deals with their suppliers) - Substitute products from other sectors that provide the same function as your product, at a lower price (e.g., smart phones replacing cameras)

- New entrants in your industry with leaner, more focused business models that enable them to use relatively little capital to enter your market and charge lower prices for some of your offerings (e.g., Porter Airline’s threat to Air Canada on select routes)

- Traditional competitors who may spark price wars that reduce your profitability and may even drive you out of business

No graphic depicting Porter’s 5 Forces Model acknowledges the existence of the environment or society. Remarkably, Ed Freeman’s Stakeholder Theory (1983) did not include the environment and society as stakeholders, either. In that era, they were just considered irrelevant background givens. Times were simpler in the 1970s and the latter half of the 20th century. Those were the good old days.

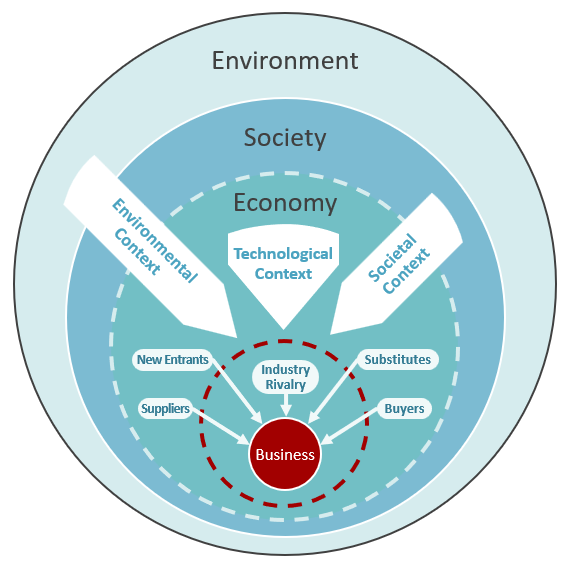

Future-Fit Business adds 3 more forces / contexts

Times have changed. Things are more VUCA (Volatile, Uncertain, Complex, and Ambiguous) in the 21st century. There are new macro forces threatening companies. A few years ago, the Future-Fit Business Foundation produced a series of free Crash Course videos about the Future-Fit methodology. One of the videos – Episode 2.4: Why a systems view is good for business – introduces a modernized version of Porter’s 5 Forces model that acknowledges the environmental and societal nests and includes three additional forces. It shows “Environmental Context” coming from the Environment, “Societal Context” coming from Society, and “Technological Context” coming from the Economy.

The Future-Fit Business version of the model inspired the design of the 21st Century 5+3 Forces Model, with a couple of tweaks.

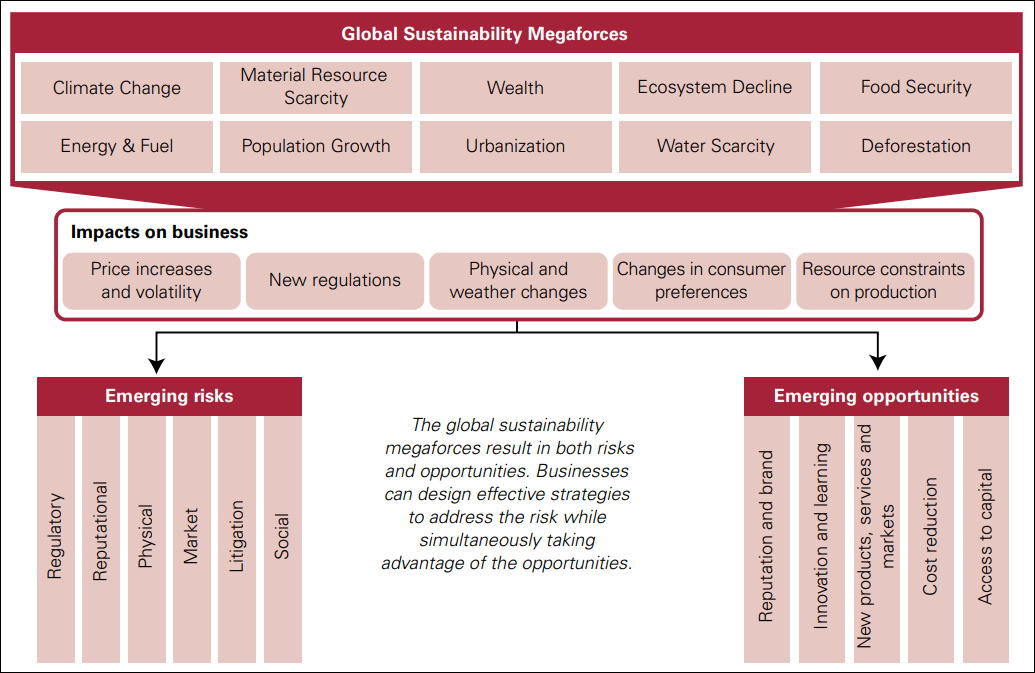

KPMG coined the “megaforces” term

The “megaforces” terminology used in the 21st Century 5+3 Forces Model was coined by this insightful KPMG report: “Expect the Unexpected: Building business value in a changing world.” Published in 2012 (note the 21st century date), it includes this figure:

The “Global Sustainability Megaforces” are sustainability-related risks. The figure shows how those megaforces impact business, forcing companies to consider how they will mitigate emerging risks and capture emerging opportunities. I often use this figure to set up the business case for sustainability. It makes environmental and societal conditions relevant to business success.

KPMG’s compelling “megaforces” terminology is used for the three outside-in forces in the 21st Century 5+3 Forces Model. Because they are dangerous threats, they are depicted in red. Because they are mega, they are the largest arrows. The “21st Century” label signals the model’s appropriateness today. To acknowledge that the model is built on Porter’s 5 Forces Model, it is labelled “5+3,” rather than “8”.

WEF itemizes the megaforces

In 2006, the World Economic Forum (WEF) published its first annual Global Risks report. It ranks global external risks to economies and businesses. Note that the WEF did not need to warn of these risks in the 1900s – they were not significant enough to worry about then. They are now. WEF sorts the global risks into five categorizes. In 2024, the WEF report identified 34 high-severity global risks to economies and companies in the next 10 years. The risks in each category are listed in order of ranked overall severity:

- Environmental: Extreme weather events (1st); Critical changes in Earth systems (2nd); Biodiversity loss and ecosystem collapse (3rd); Natural resource shortages (4th); Pollution (10th); Non-weather related natural disasters (33rd)

- Societal: Involuntary migration (7th); Societal polarization (9th); Lack of economic opportunity (11th); Erosion of human rights (18th); Infectious diseases (19th); Chronic health conditions (20th); Insufficient public infrastructure and services (21st); Unemployment (27th)

- Geopolitical: Interstate armed conflict (15th); Geoeconomic confrontation (16th); Inter-state violence (22nd); Biological, chemical, or nuclear hazards (26th); Terrorist attacks (34th)

- Economic: Concentration of strategic resources (13th); Debt (17th); Disruptions to critical infrastructure (23rd); Disruptions to a systematically important supply chain (25th); Economic downturn (28th); Labour shortages (29th); Asset bubble bursts (30th); Illicit economic activity (31st); Inflation (32nd)

- Technological: Misinformation and disinformation (5th); Adverse outcomes of AI technologies (6th); Cyber insecurity (8th); Technological power concentration (12th); Censorship and surveillance (14th); Adverse outcomes of frontier technologies (24th)

The WEF itemization of the megaforces is sobering. All these risks to business are global. If they don’t directly impact businesses themselves, they may impact the other five players in Porter’s model, especially Buyers and Suppliers somewhere else in their value chains.

If the business of business is business, it behooves businesses to mitigate these threats to their profits. Previously, environmental and societal crises were someone else’s problems. Now, they are businesses’ problems. The prioritized, highly-ranked environmental and societal threats provide a helpful checklist of sustainability-related risks to mitigate when developing strategies and scenarios for success in the 21st century. As the KPMG figure suggests, smart modern-day business leaders mitigate those emerging risks and capture the emerging opportunities.

Important stakeholders care

If business leaders still don’t get it, they should be aware that important stakeholders do. Bankers and investors are especially concerned about how well their client companies are preparing for Environmental Megaforces. For example, in 2017, the Task Force on Climate-related Financial Disclosures (TCFD) published its recommendation that companies need to disclose to bankers and investors how company future financials might be materially impacted by climate-related risks, and how the company is mitigating those risks. Stock exchanges are asking listed companies similar pointed questions. Customers practicing sustainable procurement want to know how well-prepared suppliers are for the megaforces, and what they are doing to reduce their contributions to those threats. So, important stakeholders care. CEOs care about what important stakeholders care about.

Meet them where they are

It is often difficult to convince busy, hard-nosed business executives to pay attention to sustainability impacts. They may care personally about environmental and social issues, but may not yet consider them as material factors in their strategic planning deliberations. Let’s meet business leaders where they are. They probably learned about Porter’s 5 Forces Model in business school. Acknowledge that addressing those five forces is still necessary, but help them see that it is no longer sufficient.

Share the latest WEF Global Risk report with them to help them grasp the challenging 21st century VUCA economic context. Remind them of the need for TCFD-recommended disclosures to providers of capital. Encourage them to use the 21st Century 5+3 Forces Model as the overarching framework in their enterprise risk management (ERM) and strategic planning deliberations. Position initiatives like Net-Zero Procurement as strategic responses to the climate crisis megaforce, not just an optional nice-to-do.

Business leaders still clinging to Porter’s 20th century 5 Forces Model are overlooking the additional three 21st century megaforces at their peril. Let’s help them see the light. and use the 21st Century 5+3 Forces Model as compelling context for strategic sustainability-related initiatives.

For blog subscribers, please click here to visit my site and provide feedback. A slide about the 21st Century 5+3 Forces Model will be included in the next quarterly update to my Master Slide Decks, to which anyone can subscribe.