Aligning ESG Benefits with the Income Statement

We need to make it easy for CEOs, CFOs, and others in the C-suite to see how embedding sustainability strategies into the company’s strategies and operations will contribute to the firm’s success. That is, we need to connect the dots between typical financial statements and the benefits that can be realized from smart environmental, social, and governance (ESG) approaches and programs. Aligning ESG benefits with income statement elements helps executives see the relevance of sustainability initiatives to their current financial priorities.

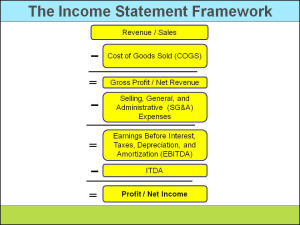

The sidebar shows the basic elements of an income statement, also known as a profit and loss (P&L) statement. It’s pretty straightforward, even for financially-challenged sustainability champions. It takes the top-line revenue that the company makes from its sales and subtracts the labor and material costs of producing those sold goods (COGS) to calculate the gross profit. Then it subtracts the overhead, staff, operating, and selling (SG&A) expenses to arrive at the EBITDA earnings—a bit of a tongue-twister of an acronym.

Net income, or profit, is what’s left on the bottom line after subtracting the interest, tax, depreciation, and amortization expenses.

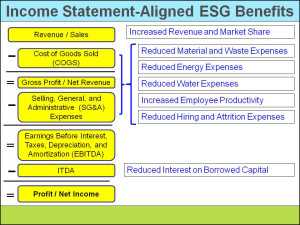

Each of the seven benefits associated with smart ESG strategies can then be arrayed beside the elements of the income statement that it most benefits. “Increased Revenue and Market Share” is easy to position beside Revenue. The next three areas of benefit—“Reduced Material and Waste Expenses,”

“Reduced Energy Expenses,” and “Reduced Water Expenses”—apply to both COGS and SG&A expenses, as do “Increased Employee Productivity” and “Reduced Hiring and Attrition Expenses.” The brackets in the slide beside these five benefits suggest that they are partly helpful in reducing COGS and partly helpful in reducing SG&A. A manufacturing company would realize the biggest savings in COGs since that’s where its labor, energy, water, and material costs to produce their goods are recorded.

A non-manufacturing company would see more of those savings in the SG&A line, since its COGS would be much less significant for a company not manufacturing its goods.

Finally, “Reduced Interest on Borrowed Capital” can be an important benefit. The potential benefit of a few basis points lower interest rate on borrowed capital affects the “I” (Interest expense) in “ITDA.”

By aligning ESG-related benefits with the income statement framework, it becomes evident how and where each benefit contributes to a more positive profit. Using financial language improves sustainability champions’ credibility. Being able to relate the so-what’s of ESG benefits to the income statement enhances that credibility further.

Bob

Comments are closed.