Aligning ESG Benefits with the Value Chain

Executives are continuously looking for ways to make the company’s value chain more robust and resilient. Smart environmental, social, and governance (ESG) strategies and programs can help.

As pointed out in my last two blogs, we need to make it easy for CEOs, CFOs, and others in the C-suite to see how embedding sustainability strategies into the company’s strategies and operations will contribute to the firm’s success. We have shown how ESG benefits relate to the executives’ 2011 priorities (Aligning ESG Benefits with Executives’ Top 10 Priorities, May 17, 2011) and to the income statement (Aligning ESG Benefits with the Income Statement, May 29, 2011). This week, we’ll show how ESG benefits help strengthen key links in the value chain.

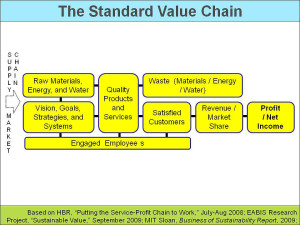

The sidebar shows the links in the standard value chain. Reading from left to right, the company takes guidance from the market and develops its vision, goals, values, strategies and systems that will enable its success. If it is a manufacturing company, it makes quality products from raw materials, energy, and water. Companies in every sector want to attract, retain, and engage talented employees to deliver its services and support customers.

<

An unfortunate byproduct of the company’s operations is waste. On the other hand, if the company’s products and services delight customers, the resulting revenue stream leads to the goal—bottom-line profits.

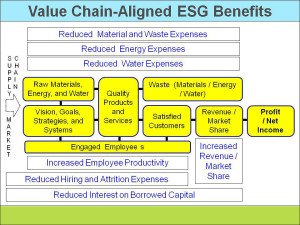

Each of the seven benefits associated with smart ESG strategies can then be arrayed beside the links in the value chain it most benefits. The first three areas of benefit—“Reduced Material and Waste Expenses,” “Reduced Energy Expenses,” and “Reduced Water Expenses”—help improve the efficiency of links throughout the company’s operations. “Increased Revenue / Market Share” is easy to position against the Revenue link.

“Increased Employee Productivity” and “Reduced Hiring and Attrition Expenses” help the engaged employee link. Finally, “Reduced Interest on Borrowed Capital” can be an important benefit that helps a higher proportion of the revenue flow through to the bottom line instead of being diverted to pay interest on borrowed capital.

By aligning ESG-related benefits with the value chain framework, it becomes evident how and where each benefit strengthens important links. Using relevant frameworks improves sustainability champions’ credibility. Being able to relate the so-what’s of ESG benefits to the standard value chain enhances that credibility further.

As usual, the above slides are from my Master Slide Set.

Please feel free to add your comments and questions using the Comment link below. For email subscribers, please click here to visit my site and provide feedback.

Bob

Comments are closed.