5 Reputational Risks to Revenue without Sustainability Strategies

If a company decides to take a pass on sustainability strategies, it behooves sustainability champions to forewarn them that they may be jeopardizing their reputation with their customers. That reputational risk can quickly translate into lost revenue if customers decide they are more comfortable doing business with competitors.

If a company decides to take a pass on sustainability strategies, it behooves sustainability champions to forewarn them that they may be jeopardizing their reputation with their customers. That reputational risk can quickly translate into lost revenue if customers decide they are more comfortable doing business with competitors.

It helps to size the potential revenue at risk by estimating its impact and factoring it by the probability of it occurring within the next three to five years. Assuming the company’s current revenue is $500 million, let’s look at a methodology for sizing five reputational risks to revenue:

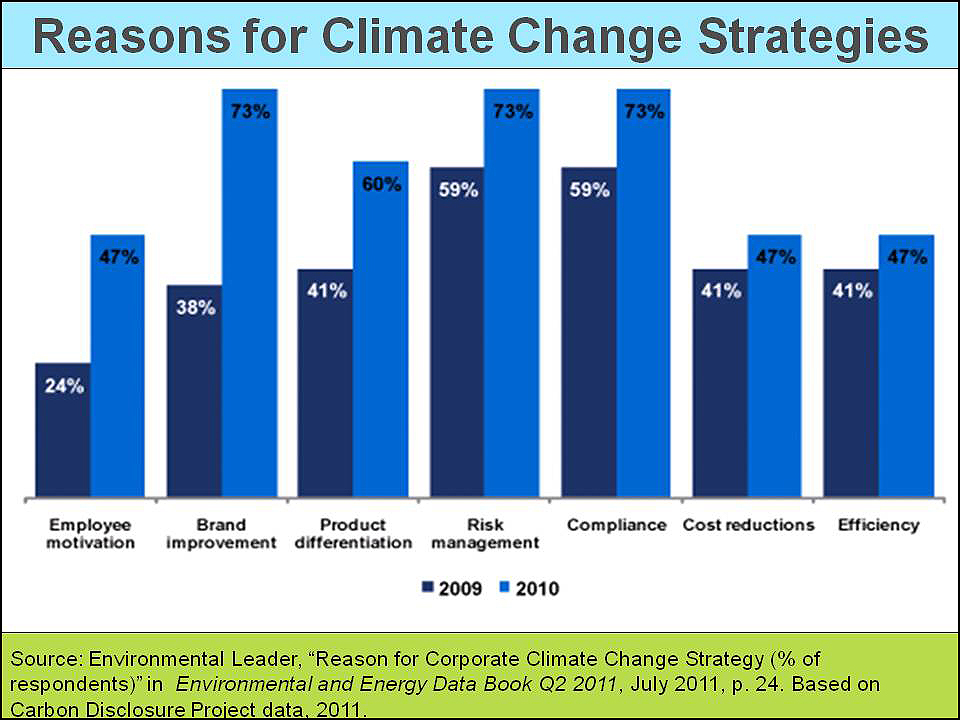

1. Risk to revenue from poor reputation on energy and carbon management:This is directly related to customers’ climate change concerns and their perceptions of the company’s sincere efforts to reduce its carbon footprint. In fact, risk mitigation is the main reason companies pay attention to their carbon footprints, as shown in the adjacent slide.

If we assume 5% of revenue is at risk and there is a 25% probability of this impact within the next three to five years, that results in $6,250,000 of revenue at risk.

2. Risk to revenue from poor reputation on water management: All industries are wrestling with the critical issues of peak water, water footprinting, and embedded water in both products and services. How companies address, or fail to address, these concerns may increasingly be seen as a matter of fiduciary duty and reputation. If we assume 5% of revenue is at risk and there is a 25% probability of this impact within the next three to five years, that results in another $6,250,000 of revenue at risk.

3. Risk to revenue from poor reputation on materials and waste management: As well, environmental pollution is often a companion of desperate efforts to find, mine, and refine vital natural resources. One of the ways in which a company’s reputation can be sullied is by direct or indirect involvement in the abuse of people, especially indigenous people, who get in the way of resource extraction. Reputation-destroying news stories about these social and environmental impacts can lead to customers going elsewhere for their products and services. If we assume 5% of revenue is at risk and there is a 20% probability of this impact within the next three to five years. That results in another $5,000,000 of revenue at risk.

4. Risk to revenue from poor reputations of the company’s suppliers or customers: No longer are companies expected to report only on their own operations; now they are also held accountable for the operations of their suppliers. When a company’s reputation is only as good as the reputation of the worst-behaving supplier in its supply chain, it is exposed to guilt by association. If we assume 5% of revenue is at risk and there is a 10% probability of this impact within the next three to five years, that results in another $2,500,000 of revenue at risk.

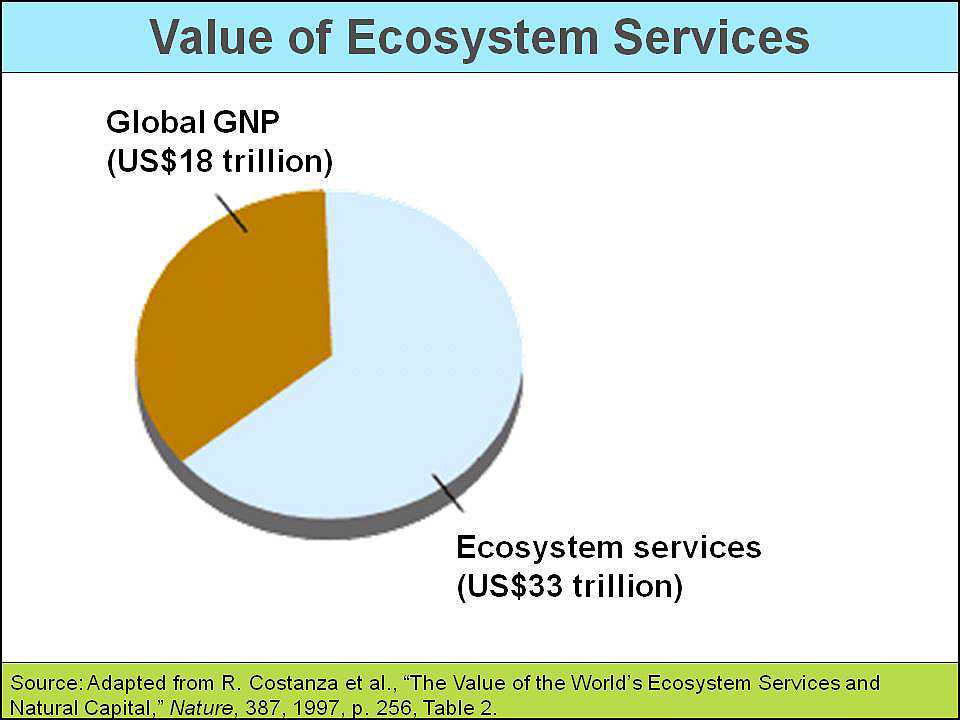

5. Risk to revenue from poor reputation on eco-system damages:As shown in the adjacent slide, the value of ecosystem services is about $33 trillion. A study from environmental research group Trucost estimated the cost of environmental damage by the 3,000 biggest companies in the world as about $2.2 trillion in 2008.

That figure equals 6% to 7% of the companies’ average revenue. We assume 5% of a company’s revenue could be at risk when the public learns of its externalized cost of damages to vital ecosystems. Assume an ultra-conservative 1% possibility of this nascent impact being internalized in the next three to five years. That results in another $250,000 of revenue at risk.

Using the above very conservative assumptions to quantify potential percentages of revenue at risk and the probabilities of this happening in the next three to five years, these five risks could put $20,250,000 of the company’s current $500,000,000 of revenue at risk. That is about 4% of its revenue. That’s huge. This methodology yields similar results, regardless of the company / size.

Next time, we will look at two more risks to revenue. Stay tuned …

As usual, the above slide is from my Master Slide Set.

Please feel free to add your comments and questions using the Comment link below. For email subscribers, please click here to visit my site and provide feedback.

Bob

Comments are closed.