Further on the Robin Hood Tax

In my December 13 blog, 3 Punchy Videos on How to Span the Wealth Chasm, I used three videos to highlight excellent reform proposals to help address the underlying causes of unjust and risky wealth inequities. In a wonderful example of synchronicity, other commentators made similar points that same week. On December 15, Hazel Henderson reinforced the wisdom of a Robin Hood Tax which was the subject of the Bill Nighy clever video that I referenced in my blog.

In her insightful December 15, 2011, CSRwire Talkback article, “Transforming Finance 2.0,” Hazel Henderson makes several points about a “Robin Hood tax,” which she prefers to call a “financial transaction tax (FTT).

- Four names for the levy: “Robin Hood Tax,” “Financial Transaction Tax (FTT),” “Larry Summers tax” based on his 1989 paper, or the “Tobin Tax” first proposed by James Tobin in the 1970s.

- Status: It is embraced by many European countries and the G-20 after widespread campaigning by Attac, OXFAM, and many global civil society organizations.

- Why it is gaining traction: As Hazel Henderson says, “Governments impoverished by their foolish bailouts of bankers and bondholders are now desperate for new revenues. Many see the FTT as the best way to downsize the global financial bubble, curb high-frequency trading without hurting real investors and raise billions to restore their budgets and other reforms in my discussion scenario, Looking Back from 2010.”

- Practical doability: Often financial institutions, as irreverently portrayed in the Bill Nighy clever video, push back, saying it would be way too complicated to administer. Hazel Henderson and Alan F. Kay proposed an FTT in the 1990s and developed a patented computer program to simplify its collection, FXTRS. Apparently, the mechanism exists to figure out and levy the tax. If it exists, it’s possible.

Let’s suppose it were possible to implement. How much would it raise? It depends on the tax rate and on which transactions are taxed. The most proposed rate for a Robin Hood tax is a mere 0.05%, or 5/100th of one percent of the value of each transaction. The Chicago Political Economy group cites between $750 billion and $1.2 trillion per year (2005–2009) could be raised by such a tax.

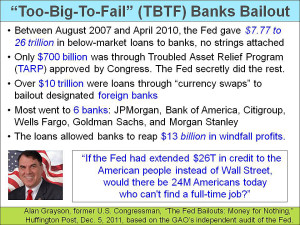

So what? Compare that to the $700 billion in the Troubled Asset Relief Program (TARP) approved by Congress to bail out “Too-Big-Too-Fail” (TBTF) financial institutions. If there had been a reserve built from an FTT, the financial institutions could have bailed themselves out without tapping into taxpayers’ funds.

As shown in the adjacent slide, some estimates of the U.S. Federal Reserve’s secret bailout of domestic and foreign banks are in the trillions of dollars, which is staggering. If this largess were tempered by the availability of funds raised by a financial transaction tax, perhaps the Fed would be less fast and loose with taxpayers’ money. So an FTT / Robin Hood Tax / Tobin Tax / Larry Summers tax is doable, relatively painless, and readily able to be administered.

It’s timely. It would help restore badly-eroded trust and confidence in the financial sector and capitalism in general. Let’s do it.

As usual, the above slide is from my Master Slide Set.

Please feel free to add your comments and questions using the Comment link below. For email subscribers, please click here to visit my site and provide feedback.

Bob

Comments are closed.