4 Fixes for Risky Income Inequality

A companion debate to how much employees should be paid (see my last blog) is what the ratio of CEO pay to average worker pay should be. The debate usually centers on three questions: what is the ratio now, what should it be, and what steps can be taken to get us closer to what it should be? There may also be a fourth question: how large can the ratio become before the inequity damages economic growth and social cohesion? In this blog, I’ll discuss 4 fixes for this risky income inequality.

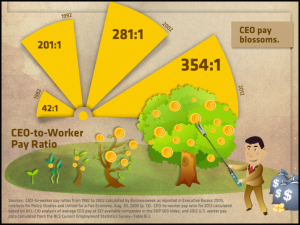

Today the ratio of CEO income to average worker pay varies by company and by company size. “Pay” is total compensation, including executive’s stock options. For large publically traded companies in the U.S., the ratio of CEO to average worker pay is 354:1. The AFL-CIO has created a world map that reveals the pay ratio for large companies in the industrialized world. In Canada, it is 206:1.

It is an inconvenient truth that the ratio is trending wider each decade. In 1982, the ratio was 42:1. Under Ronald Regan’s 1981-1989 presidential watch, the Gordon Gekko “Greed is good” mentality became the new mantra. By 1992, the ratio had skyrocketed to 201:1, five times what it was just ten years earlier. With that early traction, the ratio has become increasingly outrageous. By 2002, it was 281:1 and in 2012 it surged to 354:1. Under the spell of the “Lake Wobegon syndrome” where everyone believes their kids are above average, executive compensation committees cultivate the upward spiral as they all vow to attract and retain CEOs with above average compensation packages.

The world record for pay ratio obscenity in the CEO cult is held by the Ron Johnson, CEO of J.C. Penny. When he was hired in 2011, his total compensation package was 1,795 times the wage and benefits package of the average department store worker. It turns out he wasn’t worth it. He was fired for incompetence earlier this month.

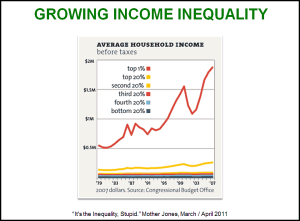

The trend line for income is aligned with the trend line for the ratio of CEO pay to average worker pay. Both gaps are widening at an alarming and unsustainable rate. For 80% of the U.S. population, income has been flat for years and shows no signs of relief. Meanwhile, as shown in the figure on the right, the average income for the top 1% of earners is taking off. CEOs are in that top 1%. In fact, they are in the top 0.01%, as calculated next.

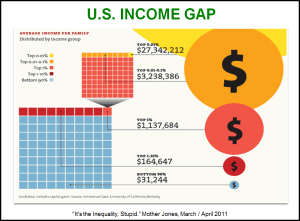

The figure on the right illustrates that the bottom 90% of U.S. workers earns an average pay of about $31,000. If we multiply that by the 354:1 ratio of CEO pay to average worker pay, the resulting $11 million income puts CEOs in the top 0.01% of income earners in the U.S. That raises questions about fairness, pay for performance, and how long this inequity will be tolerated.

If the 354:1 ratio is dangerously high, what would be safer and more just? Opinions differ.

- Wagemark-registered companies have an 8:1 wage ratio between the top decile (10%) and bottom decile of earners in a company.

- Whole Foods Market limits its ratio of CEO pay to average employee pay to 19:1.

- Management guru Peter Drucker advised that a 20:1 ratio is the limit if companies want to avoid employee resentment and falling morale.

- In 2010, the Hutton Review of Fair Pay in the UK public sector recommended a 20:1 maximum pay multiple for public sector executive salaries compared to their average employees.

- In 1965 in the U.S., the ratio of the average CEO salary to an average worker’s salary was 24:1, versus today’s ratio of 354:1.

It looks like best practice and experience says that a ratio of CEO to average worker pay that is somewhere between 20:1 and 25:1 would be appropriate and acceptable. Against that benchmark, the current ratio of 354:1 is indefensible.

The Conference Board of Canada tells us that it is a myth that reducing income inequity reduces incentives to work hard, to invest, and to get more education. There is no evidence that it does.

Instead, the Conference Board study shows that severe income inequity increases social unrest, increases political instability, reduces foreign investment and diminishes economic growth. The International Monetary Fund agrees that high income inequity is associated with slower and less durable economic growth. The World Economic Forum says that income disparity is the most likely global stability risk in the next decade.

There are many ideas about how income injustice could be corrected. These four would be a good start to shrinking the dangerously wide income gap.

- Reduce CEO pay. Duh! The Say on Pay initiative is a hopeful effort to give corporate shareholders the right to vote on the executives’ remuneration packages, including their too-aptly-named golden parachutes which make pay-for-performance a joke. Requiring CEOs to defend their rapacious pay packages will reveal the fragility of their supporting rationalization.

- Disclose pay ratios. Is it because companies are not proud of the ratio that they consider it a corporate secret? Sunlight is the best disinfectant. In 2010, the Dodd-Frank law was passed by the U.S. Congress. It requires companies to reveal their CEO-to-median-worker pay ratios. However, the U.S. Securities and Exchange Commission still has not implemented the law, so it is toothless. Require the SEC force stock exchanges to de-list companies that do not disclose their pay ratios.

- Treat stock options as an expense. Incredibly, they are not treated that way now. They are free. If shareholders saw how stock options included in executives’ compensation impact profits, they would be more likely to question their efficacy. Opponents say it is too complicated to calculate the value of stock options. Tough. Figure it out and expense them.

- Increase employee wages. There are two ways to reduce a ratio: reduce one side or increase the other. As proposed in my last blog, all employees should be paid at least a living wage. That would significantly lower the ratio of CEO pay to average employee pay.

CEOs will always be paid more than their workers, as they should be. It’s a question of degree. Severe income inequality is bad for workers, bad for society, bad for the economy, and bad for business. It’s unjustifiable. It’s risky. It’s stupid. It’s time to wise up and fix it.

As usual, the above slides are from my Master Slide Set.

Please feel free to add your comments and questions using the Comment link below. For email subscribers, please click here to visit my site and provide feedback.

Bob

Comments are closed.