6 Reasons Why I’m Writing My First-Ever Integrated Report

I’ve had a love-hate relationship with integrated reports. They are supposed to combine fragmented financial and sustainability reports into one report that explains how much financial and non-financial value a company created for all its stakeholders during the reporting period. That’s a good idea, but I’ve have been disappointed with the incoherence of most so-called integrated reports that I’ve seen so far. That disappointment leads me to the first of 6 reasons why I’m writing my first-ever integrated report for my sole proprietorship, Sustainability Advantage

- Put up or shut up

It’s easier to criticize behavior than model it. I’ve served on a couple of panels providing feedback to companies on their integrated reports. An integrated report is supposed to show how integrated thinking is working for the company. Integrated thinking is about routinely considering how any business decision, big or small, might impact the environment, society, the business and other important stakeholders. Integrated decision-making leads to actions that create value for all stakeholders over the short, medium and long term. A model integrated report <IR> would show how integrated thinking contributes to company success. It’s time to be audacious and show what a model <IR> looks like, using my own business as the case study. - Verify the guidance

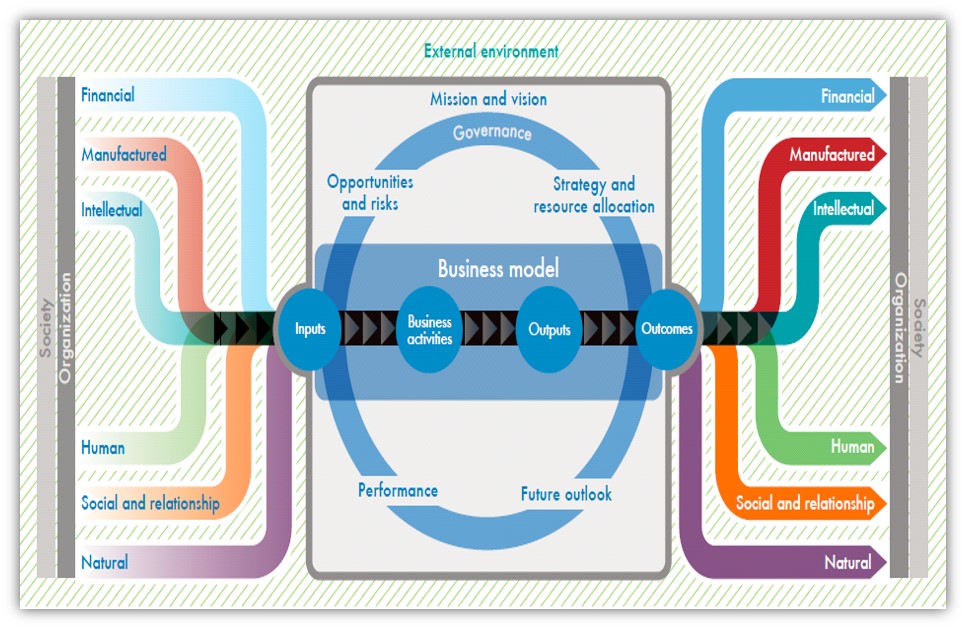

The International Integrated Reporting Council (IIRC) leads global integrated reporting efforts. Its International <IR> Framework document provides guidance on how to write an <IR>. It highlights in bold italics what must be included in “any communication claiming to be an integrated report.” It outlines seven guiding principles for report content and presentation. It explains the six capitals (financial, manufactured, intellectual, natural, human, and social) that should be used to frame company performance. If a company followed the recommended framework, would it be able to tell a complete and compelling story about how it did during the reporting period? I’d like to find out, first-hand. - Road-test a new business model graphic

The IIRC uses the above “octopus” graphic to show how the six capitals feed into the company at the beginning of the reporting period and are enhanced or diminished by the company by the end of the reporting period. I’ve been exploring other business model graphics that more specifically show how and where the company impacts each of the six capitals. An integrated report would allow me to experiment with using it to show where Sustainability Advantage impacts each of the six capitals. - Eat my own tofu

For years, I have been creating tools to calculate the business case for improving company impacts on the environment, employees, and communities. The business case is built on the premise that a company’s effects on those three stakeholders matter and directly or indirectly affect the bottom line. A good integrated report reinforces that interrelatedness. I want to explore how the benefits and logic used in my business case tools can help connect the dots in an integrated report. - Make intangibles tangible

Assessing whether a company has added value to financial, manufactured, and intellectual capitals is straightforward―just compare their monetized values before and after the reporting period. Assessing whether a company has added value to “intangible” natural, social and human capitals is trickier. I’m confident that the Future-Fit Business Benchmark can help appraise company impacts on those three non-financial capitals. The Future-Fit Business Benchmark (FFBB) is a science-based description of what a truly sustainable company would look like on planet Earth: the company needs to score 100% on all FFBB’s 23 mandatory, cause-no-harm goals for the environment, society, and employees to show that it is not diminishing the value of those “capitals.” Performance on 20 additional, optional, FFBB do-some-good goals would show whether it is adding value to those capitals. An integrated report gives me a chance to confirm that the FFBB can be used to determine company impacts on natural, social, and human capitals. - Self-assess my own sustainability

I helped develop the FFBB but I have not yet used it to self-assess my sole proprietorship. An integrated report for Sustainability Advantage that uses FFBB to determine impacts on natural, social, and human capitals would require me to do that. It’s about time.

So, I’m writing my first integrated report to describe Sustainability Advantage’s performance in 2017. As a bonus, my empathy for people doing their first sustainability / integrated report has increased significantly. It’s a grunt. It’s taking much longer than I anticipated but its also more instructive that I thought it would be. It’s a great capstone project that ties together things I’ve been working on and thinking about for 18 years. Fun!

Stay tuned …

Please feel free to add your comments and questions using the “Leave a reply” comment box under the “Share this entry” social media symbols, below. For email subscribers, please click here to visit my site and provide feedback.

Comments are closed.