Financial Impacts of Climate Estimators

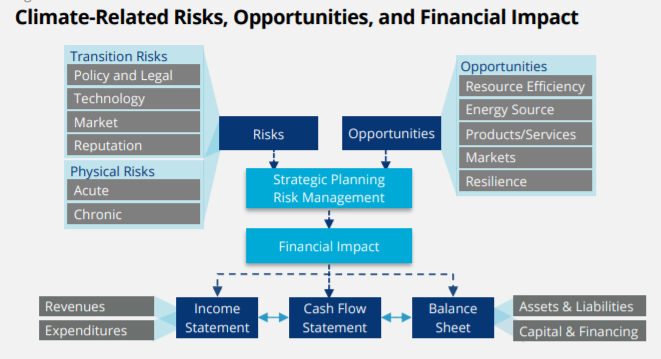

The Task Force on Climate-Related Financial Disclosures (TCFD) recommends disclosure of the financial impacts of climate-related risks and opportunities on an organization. That is, in order to make better informed financial decisions, investors, lenders, and insurance underwriters need to understand how climate-related risks and opportunities are likely to materially impact an organization’s future financial position as reflected in its income statement, cash flow statement, and balance sheet, as outlined in the above figure.

Financial Impacts of Climate Form (FICF)

The Financial Impacts of Climate Form (FICF) is a free, open-source tool, designed to help companies develop qualitative TCFD-aligned disclosures of climate-related information. It assesses the financial impacts as low / medium / high, and time horizons as short-term / medium-term / long-term. The company defines the meanings of those descriptors in dollar ranges and year ranges, respectively. The tool specifically includes the following:

- A calculator for the company’s current Scope 1, Scope 2 and Scope 3 GHG emissions.

- A framework for a qualitative estimate of the projected impacts (low / medium / high) of climate-related risks on company revenues, expenses and asset values, and the resulting impacts on income statements, cash flow statements and balance sheets, in the short-term / medium-term / long-term.

- A scoping of “Project 50×30” which would enable the company to meet the science-based Net-Zero Standard target of reducing its GHGs by 50% by 2030, while mitigating the above risks. The scope includes qualitative estimates (low / medium / high) of the amounts of capital required in the short-term / medium-term / long-term for Project 50×30.

- A framework for a qualitative estimate of the projected impacts (low / medium / high) of Project 50×30-related opportunities on company revenues, expenses and asset values, and the resulting net impacts on income statements, cash flow statements, and balance sheets, in the short-term / medium-term / long-term.

The FICF could be used for internal management purposes, and as an outline for a subsection of the Management Discussions and Analysis (MD&A) section of the company’s annual report. That subsection would provide management estimates of how climate change-related risks are reasonably likely to affect future financial statements and how Project 50×30 mitigates those impacts.

Click the above heading or here to download the latest version of the free, open-source FICF.

Feedback: The tool is being continuously improved. Your suggestions are welcome. Please send your ideas to bobwillard@sustainabilityadvantage.com. Thanks.

Financial Impacts of Climate Calculator (FICC)

The Financial Impacts of Climate Calculator (FICC) was featured in the May 2022 issue of TCFD’s Industry-Led Initiative Spotlight. It provides quantified disclosures. It describes the financial impacts in dollar amounts and the time horizons in specific years. Because it uses quantified amounts, it is able to generate graphs of cash flow and profit impacts. It also calculates the ROI / cost-benefit analysis of Project 50×30 to support the company’s decision to undertake it. It includes all TCFD-recommended disclosures. In particular, it includes:

- A calculator for the company’s current Scope 1, Scope 2 and Scope 3 GHG emissions.

- A calculator for the projected monetized impacts of climate-related risks on company revenues, expenses and asset values, and the resulting impacts on income statements, cash flow statements, and balance sheets, over the next eight years.

- A scoping of “Project 50×30” which would enable the company to meet the science-based Net-Zero Standard target of reducing its GHGs by 50% by 2030, while mitigating the above risks. The scope includes estimates of the amounts of capital required for Project 50×30 over the next eight years. FICC also calculates the ROI / cost-benefit analysis of Project 50×30, to support the company’s decision to undertake it.

- A calculator for projected impacts of Project 50×30-related opportunities on company revenues, expenses and asset values, and the resulting net impacts on income statements, cash flow statements, and balance sheets, over the next eight years. Since the impacts are monetized, FICC provides graphs of the net impacts on future financial statements over the next eight years.

The FICC could be used for internal strategic planning purposes, and as an outline for a subsection of the Management Discussions and Analysis (MD&A) section of the company’s annual report. That subsection would provide management estimates of how climate change-related risks are reasonably likely to affect future financial statements and how Project 50×30 mitigates those impacts.

Click the above heading or here to download the latest version of the free, open-source FICC.

Feedback: The tool is being continuously improved. Your suggestions are welcome. Please send your ideas to bobwillard@sustainabilityadvantage.com. Thanks.

TCFD, FICF and FICC Slides

The Master – Sustainable Frameworks slide deck is one of six slide decks available to Master Slide Decks subscribers. It includes:

- Sustainability reporting status

- Sustainability frameworks (includes an overview of the TCFD and how FICF and FICC frame the disclosures)

- Sustainability ranking frameworks

- Business model frameworks

The master decks are updated quarterly. The slides can be used to build your own slide decks for presentations, and are excellent micro-courses / tutorials / refreshers on key aspects of sustainability topics. They are Bob’s most valued resource.