Carbon Footprints – Net-Zero Accelerators or Decelerators?

In its 2020 Global Supply Chain Report, CDP famously found that greenhouse gas (GHG) emissions from a company’s supply are 11.4 times larger than GHG emissions from its operations. Some companies misinterpreted the startling 11.4 ratio as a signal that they should prioritize taking action on their indirect upstream supply chain-related emissions, even before taking action on their own direct operational emissions. Also, since carbon footprints of purchased products are added to the buyer’s GHG inventories in the year they are bought, buyers want the carbon footprints of purchased products to be as low as possible. So, it makes sense to prioritize buying products with the lowest carbon footprints … unless it delays and distracts from taking action on operational emissions. Ironically, carbon footprint calculations are at risk of being more of a decelerator than an accelerator of reducing GHG emissions to net-zero.

Carbon footprints are difficult to figure out

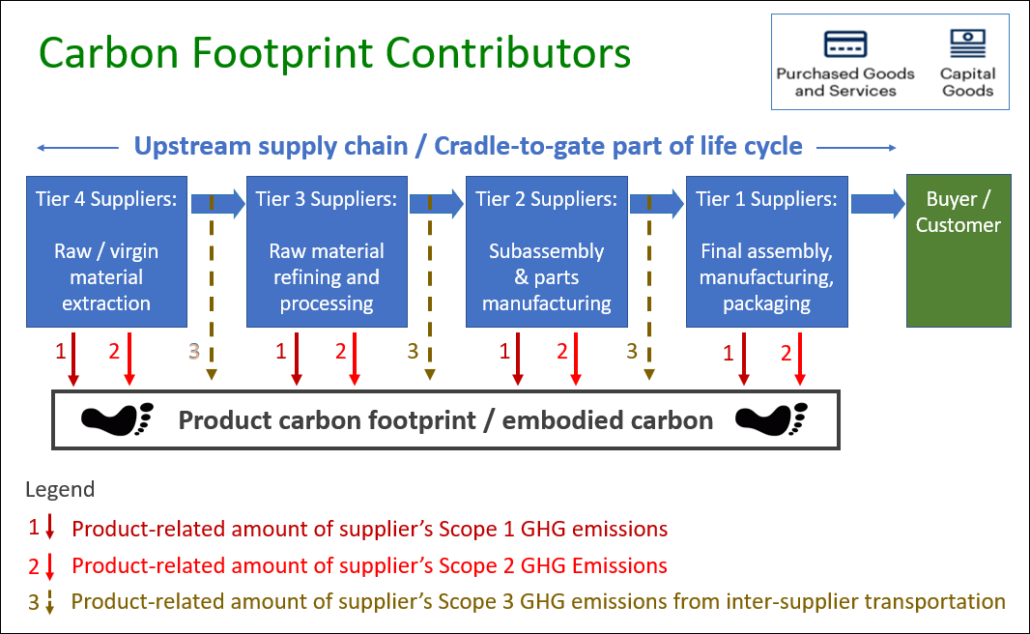

You can’t reduce what you can’t measure. Carbon footprints include GHG emissions caused during the cradle-to-gate stages of a product’s life cycle. That is, they account for GHGs directly and indirectly emitted during the extraction, refining, manufacturing, and transportation of the product before a customer buys it (see the above figure). Measuring those GHG emissions can be tricky.

Why? Usually, the bulk of emissions are caused far upstream. For example, Puma found that only 6% of its environmental footprint came from its own shops, warehouses, offices and logistics operations; another 9% came from its Tier 1 suppliers that made their shoes and apparel; another 9% came from its Tier 2 suppliers who made the insoles, outsoles, textiles and other materials used in their products; 19% came from Tier 3 suppliers that did the leather tanning and cotton weaving and dying; and 57% came from Tier 4 suppliers who reared the cattle, grew the rubber trees, farmed the cotton, produced the petroleum, etc. So, Puma’s ratio of supply chain to operational environmental impacts was 15.7:1, in the same ballpark as the 11.4 ratio that CDP found for GHG emissions. Most of the impacts occur way upstream, and are therefore very difficult to determine. No data, no measurement. No measurement, no reduction. How can we calculate carbon footprints without quality data?

GHG Protocol methodologies

The GHG Protocol’s “Technical Guidance for Calculating Scope 3 Emissions” provides four ways to estimate carbon footprints.

- Supplier-specific method – Uses GHG inventory data from suppliers throughout the cradle-to-gate supply chain. This is the holy grail of carbon footprint calculations, but it requires difficult to access ‒ and difficult to verify ‒ GHG emissions data throughout the product’s supply chain.

- Hybrid method – Uses a combination of supplier-specific GHG emissions data and secondary estimated industry average emissions factors to fill the gaps. The results are reported in a Product Carbon Footprint (PCF) Information Sheet, such as this one for my Lenovo ThinkPad X1 Carbon laptop. This method is the preferred approach for most products.

- Average-data method – Uses data on the mass (e.g., kilograms or pounds) of products purchased and relevant industry average emission factors per unit of mass. This is a simple calculation if tables of the industry average emission factors are available.

- Spend-based method – Uses data on the cost of products purchased and relevant industry average emission factors per dollar spent. The industry average data is found in publicly available tables such as the Supply Chain GHG Emission Factors for US Commodities and Industries calculated from US Environmental Protection Agency (EPA) United States Environmentally-Extended Input-Output (USEEIO) models. This is a gross estimate, but is a good interim calculation approach until quality data required for the hybrid and supplier-specific methods are available.

To their credit, some large buyers are partnering with suppliers and industry associations to develop supplier-friendly hybrid and/or supplier-specific calculators. That takes significant time, money, and expertise. For example, the procurement arm of the Canadian government has spent $700K over the last three years to develop carbon footprint calculators for three categories of goods and services: office furniture, light-duty vehicles, and professional services. Next, they will further pilot and test these methodologies in order to develop baselines and benchmarks for each product category before fully integrating the methodologies into all government procurement. This is all good work, but it takes time.

Action-ready buyer road map

My last blog explained how Net-Zero Public Procurement (NZPP) by governments is a super-leverage action to avoid catastrophic climate change. NZPP and its Net-Zero Procurement (NZP) cousin in the private sector are about purchasing the most climate-friendly products from suppliers who are most committed to science-based net-zero GHG reduction targets. By heavily weighting these product and supplier GHG-related attributes, buyers send a signal to their suppliers that net-zero actions matter and can give them a competitive advantage. Here is a five-point action plan that enables immediate NZPP and NZP implementation. without waiting for better carbon footprint estimators.

- To score all suppliers on their GHG reduction targets and plans, use a consistent assessment tool, such as the small company-friendly Net-zero Ambition Disclosure (NAD) Tool. Heavily weight (i.e., 10%-30% of the points) these suppliers’ scorecards in the bid appraisal. This encourages suppliers to aggressively reduce their GHG contributions to their products’ carbon footprints. All suppliers are also buyers. To reach deeper into the supply chain, award suppliers bonus points if they use net-zero procurement with their suppliers. The free, open-source, five-question NAD does this.

- Heavily weight (i.e., 10%-30% of the points) the score on product climate-friendly specs when appraising bids. The Product Specifications Checklist in the Net-Zero Procurement Toolkit shows how to calculate a scorecard using climate-friendly product specs like these: recycled material content, low-carbon material content (e.g., low-carbon cement and steel in construction projects); no GHG emissions when the product is used as directed; design for repairability and upgradability; access-over-ownership options; etc. In a way, these are proxies for low carbon footprints ‒ if the product meets these specs, it has a lower carbon footprint.

- In addition to the above product specs, include a specification for the carbon footprint for the product. This signals to the supplier that product carbon footprints matter. Initially, the specification simply asks if the supplier submitted one. If necessary, buyers can encourage and help the supplier to use a spend-based approach to calculating an initial estimate of the product’s carbon footprint. That’s good enough to get started, and satisfies the buyer’s need to account for the carbon footprint of purchased products in the year they are acquired. The spend-based carbon footprint is a placeholder. If/when a hybrid calculator is available, score the product’s resulting carbon footprint on how it compares to a benchmark carbon footprint for that category of product.

- Buyers should continue to work with suppliers on supplier-specific or hybrid carbon footprint calculators for priority product categories. When they are ready, replace spend-based carbon footprint estimates with these better estimates.

- The urgency of the climate crisis cannot be overstated. Our world is on fire. Firemen do not waste precious time measuring the temperature of the fire in a burning building before turning on their hoses. Let’s not let carbon footprint measurements lead to analysis paralysis. Let’s turn on the NZP and NZPP hoses now.

In summary, carbon footprint calculations are an important tool for understanding and addressing emissions in the supply chain. They should be developed in parallel with aggressive NZP and NZPP implementations that accelerate our race to net-zero.

Please feel free to add your comments and questions using the “Leave a reply” comment box under the “Share this entry” social media symbols, below. For email subscribers, please click here to visit my site and provide feedback. Slides that explain net-zero procurement and overview the referenced supporting tools are included in my Master Slide Decks, to which anyone can subscribe.