5 Realities vs the “We’re-Not-Allowed-To-Do-Sustainability” Myth

I love this Navajo proverb: “You can’t wake a person who’s pretending to be asleep.” Corporations sometimes defend their inaction on their social and environmental impacts by hiding behind Milton Friedman’s adage that “The business of business is business.” They claim that being more proactive on sustainability issues would be violating their fiduciary duty to shareholders. Nice try. They are just pretending that they are unaware of five realities that reveal that they could do more if they wanted to.

1. Corporate charters are silent on sustainability

Under for-profit companies’ articles of incorporation, the purpose of a corporation is to maximize shareholder value. Corporations can be sued by their shareholders or investors for measures that negatively affect shareholders’ financial returns. However, corporate charters do not explicitly say companies cannot undertake socially and environmentally responsible measures. They just say that such initiatives must not interfere with shareholders’ returns.

2. Corporate charters can be amended to include sustainability

Although corporate charters are silent on sustainability, they are amendable to explicitly include it. In fact, Intel did that in April 2010. It amended its charter so that its board oversight includes “matters of corporate responsibility and sustainability performance, including potential long and short term trends and impacts to our business of environmental, social and governance (ESG) issues.” Further, in February 2011, California introduced a Corporate Flexibility Act that will allow any California corporation to give social and environmental missions equal weight with its profit mission. This could be the new normal.

3. Investors can assess corporations’ sustainability

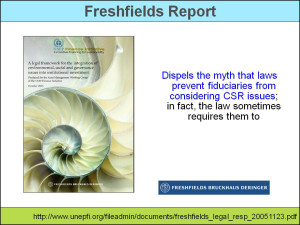

The United Nations Environment Programme Financial Initiative (UNEP FI) published a milestone report in 2005, nicknamed the Freshfields Report after the Freshfields Bruckhaus Deringer legal firm that wrote it. The report dismissed once and for all the common misperception that institutional investors are legally prevented from taking account of material environmental and social risks and interests in their assessment of corporations.

4. The SEC requires sustainability disclosure

When stock market regulators require listed corporations to disclose their environmental, social, and Governance (ESG) risks and track record, you know it is a legitimate corporate area of focus.In March 2010, the U.S. Securities Exchange Commission (SEC) Investor Advisory Committee introduced an “ESG Disclosure Work Plan” to provide guidance on how to do that. That was a huge signal that sustainability has gone from the margins into the mainstream.

5. Sustainability strategies can enhance corporate value

The final wake-up call is that, contrary to the myth that sustainability strategies interfere with corporate value and success, they actually can improve shareholder wealth. In The Sustainability Advantage, I show that a typical large corporation can increase its profits by at least 38% within five years by deploying smart sustainability strategies, and that’s a low-ball, conservative estimate. Maybe corporations should be sued by their shareholders or investors if they don’t integrate sustainability into their business strategies.

So when corporate executives pretend that they would like to embrace sustainability initiatives more aggressively but that their charters or pressure from the investment community prevents them from doing so, they are just pretending to be asleep. They know that the opposite is true. Or they do now, if they didn’t before. It’s time to wake-up and get on with it.

Bob

As usual, the above two slides are from my 800+ Master Slide Set, to which you are welcome to subscribe.