CO2 – Why 450 ppm is Dangerous and 350 ppm is Safe

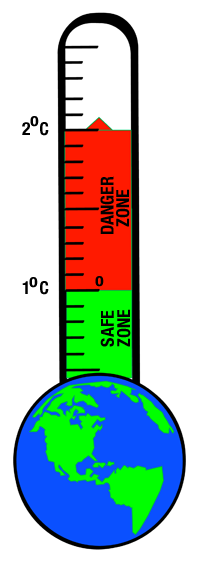

In my October 29, 2013, blog, Stranded Assets or Stranded Humanity. Choose One, I reviewed the math that supports leaving 80% of known fossil fuel reserves in the ground. That would allow us to limit the concentration of CO2 in the atmosphere to 450 ppm (parts per million) and have a 50:50 chance of limiting global warming to 2°C. Now scientists are telling us that this is a very dangerous and irresponsible strategy.

In September 2013, the Intergovernmental Panel on Climate Change (IPCC), the international body for assessing the science related to climate change, released its fifth assessment report. Authored by 250 climate scientists from 39 countries, it states: “It is extremely likely that human influence has been the dominant cause of observed warming since the mid-20th century.”The IPCC report goes on to describe the cumulative effect of our carbon dioxide (CO2) emissions. Read More