In my

last blog, I outlined three concerns that lending institutions have about companies with poor environmental, social, and governance (ESG) track records. First, environmental practices may expose borrowers to expensive legal, reputational, and regulatory risks that could jeopardize their solvency. Second, lenders want to ensure they are not stuck with the borrower’s current and past environmental liabilities if the borrower defaults on the loan. Third, lenders are wary of risks to their own reputations if the public perceives they are abetting the borrower’s irresponsible corporate behavior.

For these three reasons, laggard companies with poor ESG track records may find they pay a higher rate for their borrowed capital. The Social Investment Forum’s 2010 Moskowitz Prize for scholarly research on socially responsible investing was awarded to Rob Bauer and Daniel Hann for their paper, “Corporate Environmental Management and Credit Risk.” In it, they analyzed 1996 to 2006 data on the environmental profiles of 582 U.S. public companies and their associated cost of debt. They found:

Read More In my last blog, I outlined three concerns that lending institutions have about companies with poor environmental, social, and governance (ESG) track records. First, environmental practices may expose borrowers to expensive legal, reputational, and regulatory risks that could jeopardize their solvency. Second, lenders want to ensure they are not stuck with the borrower’s current and past environmental liabilities if the borrower defaults on the loan. Third, lenders are wary of risks to their own reputations if the public perceives they are abetting the borrower’s irresponsible corporate behavior.

For these three reasons, laggard companies with poor ESG track records may find they pay a higher rate for their borrowed capital. The Social Investment Forum’s 2010 Moskowitz Prize for scholarly research on socially responsible investing was awarded to Rob Bauer and Daniel Hann for their paper, “Corporate Environmental Management and Credit Risk.” In it, they analyzed 1996 to 2006 data on the environmental profiles of 582 U.S. public companies and their associated cost of debt. They found: Read More

In my last blog, I outlined three concerns that lending institutions have about companies with poor environmental, social, and governance (ESG) track records. First, environmental practices may expose borrowers to expensive legal, reputational, and regulatory risks that could jeopardize their solvency. Second, lenders want to ensure they are not stuck with the borrower’s current and past environmental liabilities if the borrower defaults on the loan. Third, lenders are wary of risks to their own reputations if the public perceives they are abetting the borrower’s irresponsible corporate behavior.

For these three reasons, laggard companies with poor ESG track records may find they pay a higher rate for their borrowed capital. The Social Investment Forum’s 2010 Moskowitz Prize for scholarly research on socially responsible investing was awarded to Rob Bauer and Daniel Hann for their paper, “Corporate Environmental Management and Credit Risk.” In it, they analyzed 1996 to 2006 data on the environmental profiles of 582 U.S. public companies and their associated cost of debt. They found: Read More

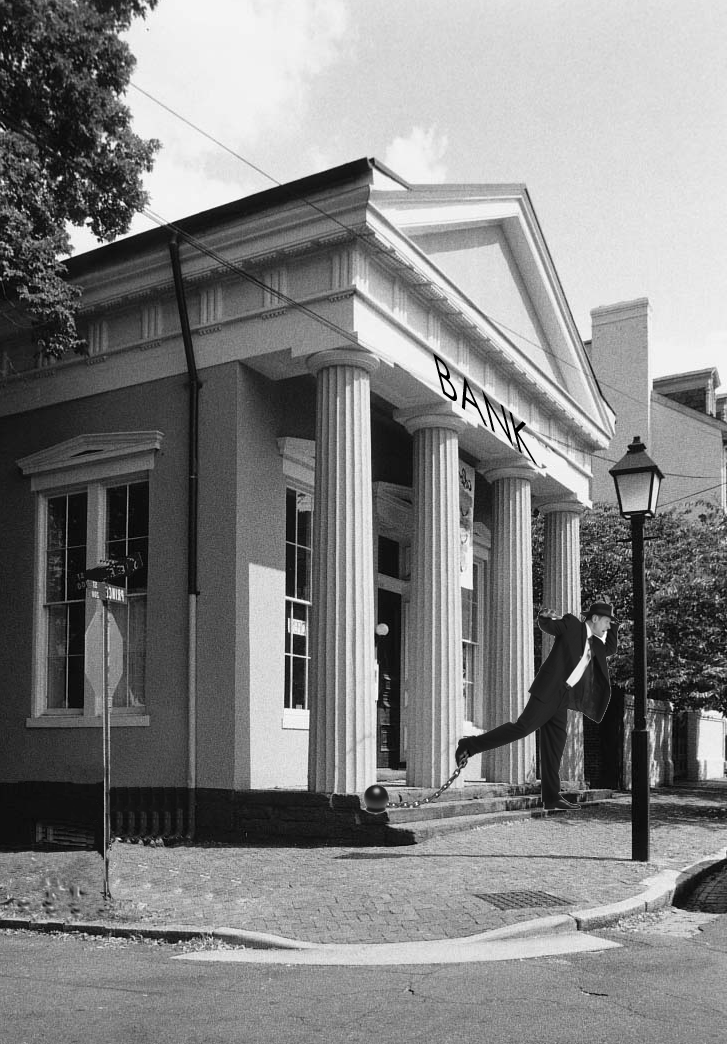

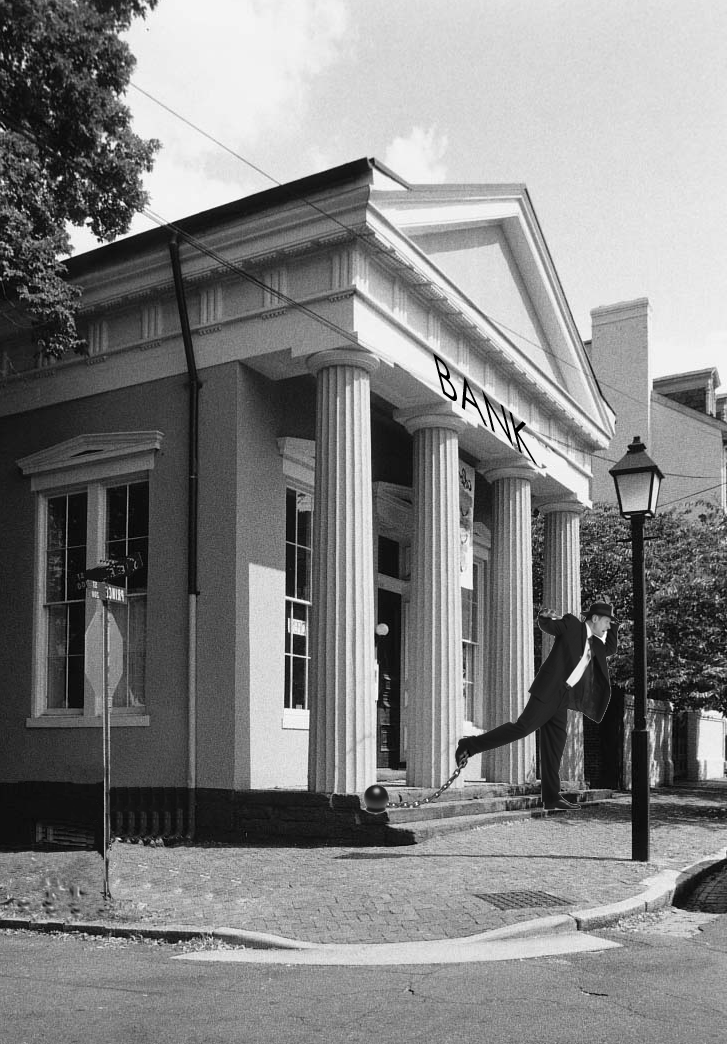

How lenders respond to a company’s request for financial assistance is somewhat driven by the applicant’s environmental, social, and governance (ESG) track record. Borrowers require financial capital in order to purchase equipment or new premises in which to produce its goods or services. Some of these capital improvements may be for pollution prevention equipment to comply with tougher environmental regulations, with energy-saving retrofits, for water conservation and treatment, or for new green production lines. Some of the loans may have nothing to do with green projects. Regardless, one cold reality applies to any loan request: Your ESG track record can be a stumbling block.

How lenders respond to a company’s request for financial assistance is somewhat driven by the applicant’s environmental, social, and governance (ESG) track record. Borrowers require financial capital in order to purchase equipment or new premises in which to produce its goods or services. Some of these capital improvements may be for pollution prevention equipment to comply with tougher environmental regulations, with energy-saving retrofits, for water conservation and treatment, or for new green production lines. Some of the loans may have nothing to do with green projects. Regardless, one cold reality applies to any loan request: Your ESG track record can be a stumbling block.

There are only two reasons a company changes: to avoid risks and / or to capture opportunities. They go for the upside, and / or run from the downside. They are attracted to the carrot, and / or want to duck the stick; the yin and / or the yang. Trying to convince a company to fully embed sustainability into its strategies and operations requires a very compelling business case. The standard business case is made up of these same two parts, shown in the figure below.

There are only two reasons a company changes: to avoid risks and / or to capture opportunities. They go for the upside, and / or run from the downside. They are attracted to the carrot, and / or want to duck the stick; the yin and / or the yang. Trying to convince a company to fully embed sustainability into its strategies and operations requires a very compelling business case. The standard business case is made up of these same two parts, shown in the figure below.

How would we recognize a sustainable enterprise if we saw one? That question has been nagging at me for years. When we celebrate companies ranked as being the most sustainable (see my April 5, 2011, blog:

How would we recognize a sustainable enterprise if we saw one? That question has been nagging at me for years. When we celebrate companies ranked as being the most sustainable (see my April 5, 2011, blog:

We are encouraged to spend our way out of the economic recession—to consume our way back to normal. This recovery recipe has been used for decades. During the recession in the 1950’s, a reporter asked President Eisenhower, “What should citizens do to help the recession recede?”

The President replied, “Buy.”

The reporter asked, “Buy what?” Eisenhower replied, “Buy anything.”

We are encouraged to spend our way out of the economic recession—to consume our way back to normal. This recovery recipe has been used for decades. During the recession in the 1950’s, a reporter asked President Eisenhower, “What should citizens do to help the recession recede?”

The President replied, “Buy.”

The reporter asked, “Buy what?” Eisenhower replied, “Buy anything.”

A picture is worth a thousand words; a video is worth a thousand pictures. As sustainability champions, it’s helpful to have a few short, crisp videos up our sleeves to help audiences understand whatever point we are making about sustainability strategies.

Here are three that remind us of the challenges we have with the social justice dimension of sustainability. Click on the arrow icon on the bottom right of each video to expand it to full screen.

A picture is worth a thousand words; a video is worth a thousand pictures. As sustainability champions, it’s helpful to have a few short, crisp videos up our sleeves to help audiences understand whatever point we are making about sustainability strategies.

Here are three that remind us of the challenges we have with the social justice dimension of sustainability. Click on the arrow icon on the bottom right of each video to expand it to full screen.

As sustainability champions, we are sometimes confronted by frustrated people who ask what we mean by “sustainability.” What they really want to know is sustainability’s relevance to them, their organization, or their community. Is it a threatening concept, or a friendly one? Or maybe it’s just a fancy, multiple-syllable word for something to which they are already paying attention, at least partially?

As sustainability champions, we are sometimes confronted by frustrated people who ask what we mean by “sustainability.” What they really want to know is sustainability’s relevance to them, their organization, or their community. Is it a threatening concept, or a friendly one? Or maybe it’s just a fancy, multiple-syllable word for something to which they are already paying attention, at least partially?

As sustainability champions, we need to respect executives’ current priorities and help them save face if they “have no time right now” for sustainability. We need to find out what executives do have time for. Then, reframe our proposals as enabling strategies to help them address their urgent, pressing challenges— rather than as one more goal to worry about. Agree with their priorities. Meet them where they are. Honor their terminology and mindset; and suggest how sustainability-based strategies will help to achieve their current goals.

As sustainability champions, we need to respect executives’ current priorities and help them save face if they “have no time right now” for sustainability. We need to find out what executives do have time for. Then, reframe our proposals as enabling strategies to help them address their urgent, pressing challenges— rather than as one more goal to worry about. Agree with their priorities. Meet them where they are. Honor their terminology and mindset; and suggest how sustainability-based strategies will help to achieve their current goals.