5 Reasons I Low-Ball Employee Productivity in the Business Case for Sustainability

As explained in The New Sustainability Advantage, sustainability strategies and programs result in higher levels of employee engagement. Engaged employees are more productive. They want their company to succeed so that it can continue to add value to the community and ecosystems which the employees care about. Engaged employees are the secret sauce in the business case for sustainability. When employees are engaged, magic happens.

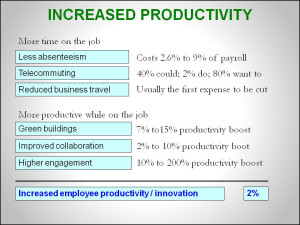

If that is the case, why do I assume only a 2% improvement in employee productivity in the business case for sustainability described in The New Sustainability Advantage? Shouldn’t the six sustainability-related contributors to increased employee productivity that are summarized in the adjacent figure add up to more than 2%? Yes, they really add up to at least 20%, but there are five reasons that I deliberately forced them not to.

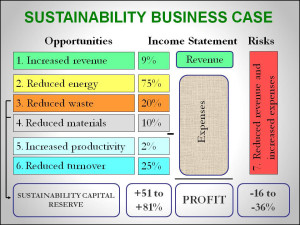

1. Keep the overall profit improvement below 100%

As shown in the adjacent figure, if a typical company were to simply use best-practice sustainability approaches already being used by real companies, it could improve its profit by at least 51% to 81% within three to five years. That is a Goldilocks range: it is high enough to get attention, but low enough to be credible. If I used the real potential profit improvement percentages from my research findings, the range would be in the hundreds … and no one would believe me. So I worked hard to factor down the potential contribution from each benefit area, especially the “Increased productivity” benefit.

2. Risk of employee productivity being the biggest contributor to profit increases

In my first version of the business case in 2002, employee productivity was the most significant contributor to the bottom line benefits, more than any of the potential eco-efficiency savings. Understandably, it was lightning rod for discussion, especially since many people consider it an intangible benefit and dismiss it. To protect the credibility of the new business case, I ensure that contributions to the bottom line from energy and waste savings exceed the contribution from employee productivity.

3. Risk of company’s not measuring productivity

It may be hard to believe, but many companies have no idea how to measure employee productivity. So they don’t. If the business case relies heavily on that benefit and a company can’t calculate it for their situation, they leave it out or attack it. That leads to them potentially dismissing the whole business case if it is too dependent on a benefit that is difficult or unusual for them to calculate. I force the employee productivity factor to be low enough to not compromise the whole business case for companies that decide to leave it out.

4. Risk of cost avoidance not being counted

Similarly, some companies are not comfortable with cost avoidance factors being included in the business case. By contrast, savings on the company’s energy bill go straight to the bottom line. They are savings. If you increase employee productivity, you avoid having to hire more people to achieve the same business results. You are still paying the same payroll, but you avoid having to increase it. That’s cost avoidance, not cost saving. Some companies count cost avoidances in their business cases; others don’t. I want to ensure that the companies that don’t count it do not dismiss the whole business case because it was too dependent on a benefit that they don’t count.

5. Risk of double counting

The benefit of employees’ increased productivity may already be accounted for in other sustainability benefits like increased revenue, reduced energy expenses, reduced materials expenses, and reduced waste expenses. That is, the current workforce employees figured out how to do more with less. So I avoid double-counting by very conservatively assuming that only 10% of the potential increased employee productivity benefit remains to be counted. It should be more like 50%, but I have to use 10% to keep the overall profit improvement down to the 51% to 81% range.

In summary, all assumptions used in the business case calculations are conservative. Why? My low-ball assumptions generate profit improvements that are astounding enough. If I use more probable assumptions, especially for employee productivity improvements, I strain the credibility of the methodology.

As a reminder, executives can plug their own numbers into the free, open source Sustainability Advantage Business Case Simulator Dashboard or Worksheets. I want executives to receive a pleasant surprise when they override the simulator’s starter set of data with their own company’s data; replace the simulator’s assumptions with their own experience, judgment, and gut instincts; and discover that the real business case is even more convincing than suggested. My strategy is to under-sell and over-deliver. That’s why I low-ball the employee productivity benefit, so executives can crank it up to reflect their own comfort level and company norms and be excited about the much higher potential in their situation.

Bob

The PowerPoint figures used above are from my Sustainability Advantage Slides set, to which you can subscribe.

Please feel free to add your comments and questions using the Comment link, below. For email subscribers, please click here to visit my site and provide feedback.

Comments are closed.