Four Strategies to Use Capital Markets as a Force for Good

We need sustainable businesses if we are to have a sustainable world. That means we need strategies to use capital markets as a force for good and we must embed environmental, social, and governance (ESG) thinking in executive’s mindsets. For the last 12 years, my strategy has been to appeal to executive’s profit motive.

I thought if I could help them see how more profitable they could be if they embraced sustainability strategies, they would stampede to make the necessary transformation. That’s what my four books, two DVDs, worksheets, dashboard, and hundreds of talks have been all about.

How’s it going so far? Okay, but way too slow. We need to add a push strategy to our pull strategy. We need to wake executives up with the down-side risk of not doing more, to compliment the up-side opportunity of higher revenue, lower expenses, and higher employee productivity and retention. The business case simulator helps companies quantify 14 risks to profit from inaction, but I should have highlighted the mother of all risks: more difficult access to capital when lenders and investors prioritize ESG factors in their company assessments.

Capital markets are gate-keepers to corporate interest in ESG. Here are four strategies to make them a force for transformational change.

1. Honor the Golden Rule

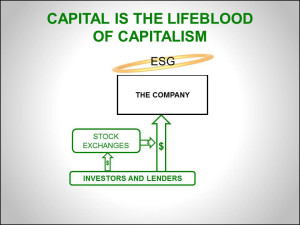

In business, the Golden Rule is: “He who has the gold, makes the rules.” Capital markets have the gold. Financial capital is the life-blood of business: companies need money from investors and lenders in order to build new facilities, launch new ventures, invest in R&D, and for other capital projects. If performance on ESG factors makes a company more attractive to providers of financial capital, it will be at the top of executives’ priority list.

2. Make ESG information necessary

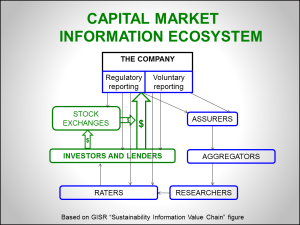

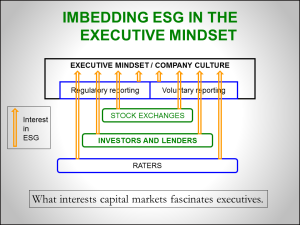

Companies generate regulatory and voluntary reports. That information is used by various players in the capital market information ecosystem. Assurers, Aggregators, and Researchers add value to it, while Stock Exchanges, Investors and Lenders, and Raters also use it directly. If ESG performance information is deemed to be material by capital markets, companies will include much better ESG information in their reports than they do today.

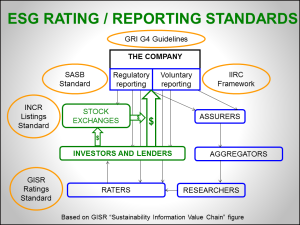

3. Harmonize five concurrent ESG standards efforts in capital markets

This is the big one. There are five concurrent efforts underway to embed material ESG standards into the capital market information ecosystem: GRI G4 indicator guidance for ESG reports; IIRC voluntary ESG reporting guidance; SASB ESG regulatory disclosure guidance; the INCR ESG Listing Standard; and the GISR ESG ratings standard. (I’ll explain these acronyms and efforts in my next blog.) They all will complete their work by 2015. Each is necessary but none is sufficient. Their real power comes when they are harmonized.

There is strength in numbers. Solos are good; a full-throated chorus is better. If the five ESG standards efforts in capital markets self-orchestrate so that they are all singing from the same page of material ESG indicators, they will imbed ESG thinking into the mindsets of providers of financial capital. Then magic happens.

My focus for the next two years will be to support these game-changing efforts in conjunction with my work with TNS Canada on a Gold Standard for a truly sustainable enterprise. I plan to align the Gold Standard criteria with the harmonized ESG KPIs developed by the above standards efforts. Where appropriate, I will encourage “zero” and “100%” metrics as goals against which company performance is assessed. For example, rather than rate companies on how much they have reduced their carbon emissions compared to their previous footprint, rate them against the aspirational “zero carbon footprint” benchmark in the Gold Standard, to spur quantum leap thinking and action.

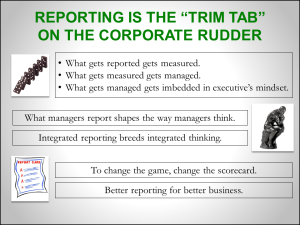

4. Use reporting as the trim tab on the corporate rudder.

A trim tab is a small surface on a rudder that makes it easier to move the rudder to change the direction of a ship. A small movement of the trim tab can cause big course corrections. Reporting is the trim tab on the rudder of the corporate ship. Companies report what matters to their important stakeholders. If their performance on the ESG front matters to capital markets, they will report on it. That starts the beautiful domino effect shown at the top of the adjacent figure.

Raters assess how attractive or unattractive a company is for lenders and investors who subscribe to their services. When Raters, Investors, Lenders, and Stock Markets want to know about companies’ efforts on the ESG front, companies will give ESG a higher priority. What interests capital markets fascinates executives. Why? Because capital is the lifeblood of business?see the Golden Rule, above.

\

Awakened by capital market interest in ESG, executives will be ready to use the business case simulator to reassure themselves that smart ESG strategies will give them a profitable sustainability advantage. Now, that’s a compelling two-part business case: avoid the risk of more difficult access to capital, while capturing the opportunity of higher profits.

Bingo.

As usual, the above slides are from my Master Slide Set.

Please feel free to add your comments and questions using the Comment link below. For email subscribers, please click here to visit my site and provide feedback.

Bob