How to Operationalize 6 CFO Recommendations for 21st Century Decision-Making

In April 2016, Accounting for Sustainability (A4S) published “CAPEX: A practical guide to embedding sustainability into capital investment appraisal.” Written by the A4S Chief Financial Officer (CFO) Leadership Network, it is an essential and practical guide by CFOs, for CFOs. It strongly urges executives to operationalize its 6 recommendations for 21st century decision-making by enhancing their capital expenditure (CAPEX) appraisal processes.

In April 2016, Accounting for Sustainability (A4S) published “CAPEX: A practical guide to embedding sustainability into capital investment appraisal.” Written by the A4S Chief Financial Officer (CFO) Leadership Network, it is an essential and practical guide by CFOs, for CFOs. It strongly urges executives to operationalize its 6 recommendations for 21st century decision-making by enhancing their capital expenditure (CAPEX) appraisal processes.

“Our financial models may have brought us success in the past and we should not abandon them now, but we should think about how new information can better inform our capital investment decisions. Measures and metrics exist, which are wider in scope and encompass more societal and environmental risks and impacts which can be incorporated alongside traditional cost of capital and risk premiums.”

“Our financial models may have brought us success in the past and we should not abandon them now, but we should think about how new information can better inform our capital investment decisions. Measures and metrics exist, which are wider in scope and encompass more societal and environmental risks and impacts which can be incorporated alongside traditional cost of capital and risk premiums.”

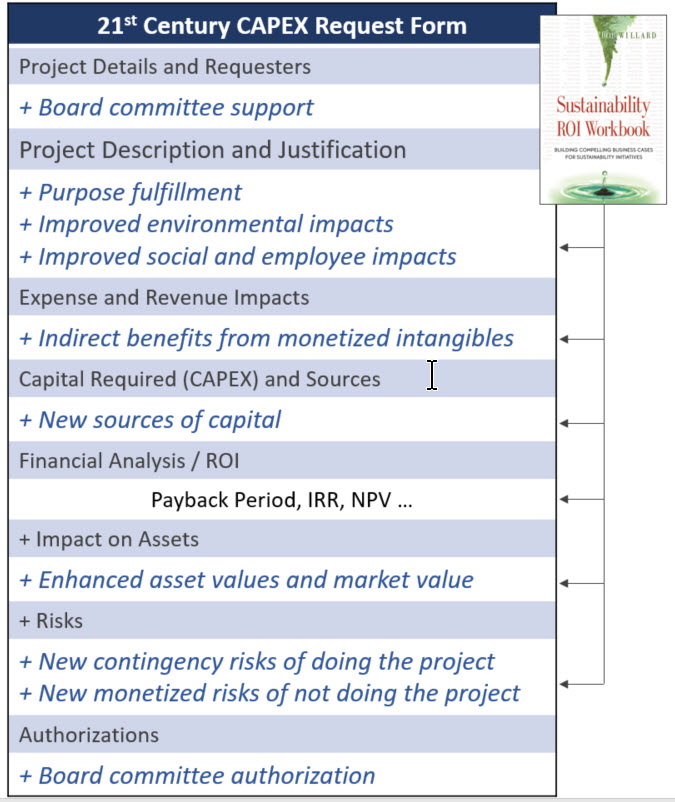

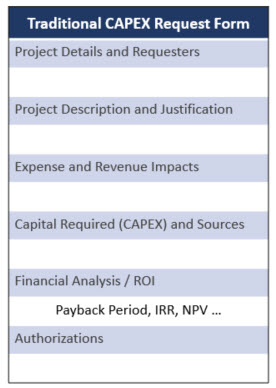

The figure on the left shows the traditional elements in a CAPEX Request Form. It is how the business case for an investment has been framed in the past. It’s worked well, but the CFO Leadership Network recommends that additional factors be considered when making capital expenditure decisions, today. “Promoting positive environmental and social outcomes is entirely consistent with the economic imperative of creating shareholder value … ‘doing the right thing’ doesn’t have to require governmental or regulatory intervention but can be driven by the business case.”

The CFO’s CAPEX report says that business cases for significant projects should take into account six new elements.

- Include how the capital project helps the company be more resilient, or future-proofed, as it meets its ESG goals

Companies have set environmental, social and governance (ESG) targets / goals for themselves to help minimize the impacts of climate change, water scarcity, resource depletion, rising expectations on the role of business in society and other sustainability issues that could have significant impacts on the company and its brand value. By incorporating how a project helps fulfill the purpose of the business and makes progress on material sustainability issues, the company can future-proof itself against impending ESG threats when making capital investment appraisals. - Demonstrate how the project will directly, or indirectly, grow revenue and save expenses

Projects that improve the company’s environmental and social impacts can build trust and enhance its social licence to operate. Improving environmental and social credentials demonstrates to stakeholders (such as regulators, customers, employees and the local community) that the company is committed to responsible business practices. This can bring indirect financial benefits through improved stakeholder relationships and faster planning consents, greater employee engagement and productivity, operational expense savings and revenue growth from customers who share the company’s values. - Show how the project’s sustainability attributes can help to reduce financing costs and increase access to capital

There is increasing evidence that companies with higher sustainability performance benefit from lower costs of capital due to a lower risk profile and increased resilience. Increasingly, there are also opportunities to gain improved access to capital as a result of strong sustainability performance (e.g., through green bonds, government grants, or support from foundations). - Include traditional financial analysis

Companies have evolved norms for payback period, internal rate of return (IRR), and net present value (NPV) associated with various classifications of projects they undertake. The extent to which the project meets these traditional financial criteria should continue to be an important decision-making criterion. The difference is that the expense savings and revenue growth opportunities used in the calculations are more inclusive of the complete suite of direct and indirect possibilities in the 21st century. - Include potential enhancements to the value of company assets

The value of the company’s real estate, vehicles and equipment may be enhanced by the project. For example, a green retrofit will increase the resale value of a building. Converting a company’s car or truck fleet to electric vehicles may increase their book value. Further, applying sustainability screens to the company’s investment portfolio may lead to investments that outperform others in the market. - Show costs of inaction

Many of the measures for mitigating emerging sustainability risks are of marginal cost when compared with the potential material costs that they help companies avoid. Planning sustainability into capital projects upfront frequently proves cost-effective overall―and, with significant value at risk, it is likely that companies cannot afford not to.

How might CFOs operationalize these recommendations from their peers? Simple. Embed the new information in an enhanced “21st Century CAPEX Request Form.” The resulting form might look like the one in the figure below.

But how would project proposers do all the required calculations to feed these additional elements in the enhanced CAPEX Request Form? The figure shows how the free, open-source Sustainability ROI Workbook helps identify, quantify, and monetize both new and traditional elements. The Excel workbook is the engine behind the form and is designed to provide all six recommended elements. A tailorable template for a 21st Century CAPEX Request Form is available in both online and Excel versions.

Further, the CAPEX report strongly encourages CFOs to use a multi-criteria analysis (MCA) structured decision-making tool to make better informed decisions about projects that require capital expenditures in the 21st century. A key feature of MCA is its emphasis on the judgement of the decision-making team in determining the relative weight or importance of each decision-making criterion―that is, the weight of each element in the form―and scoring how well the proposed project meets those criteria. Whichever project has the highest total weighted score will earn priority consideration from CFOs when they allocate the company’s limited pool of capital. Happily, the Sustainability ROI Workbook includes a sample MCA appraisal tool, as well, to help CFOs assign appropriate weights and scores.

A company’s CAPEX Request Form embodies how decisions are made in the C-suite―the considerations that are weighed when making important business decisions. It embodies executive thinking about what matters. In the 21st century, the company’s track record on environmental and social issues matters. When the CAPEX form includes elements suggested by the A4S CFO Leadership Network, it helps the company use integrated thinking and integrated decision-making to position itself to be a more responsible and successful business.

It’s the 21st century. It’s time to update C-suite decision-making tools. Let’s start with the CAPEX Request Form.

Please feel free to add your comments and questions using the “Leave a reply” comment box under the “Share this entry” social media symbols, below. For email subscribers, please click here to visit my site and provide feedback. Slides shown, plus the referenced online and Excel templates for a 21st Century CAPEX Request Form, will be included in my next quarterly release of Latest Workbook & Slides, to which anyone can subscribe.