5 Shameful Tax Avoidance Numbers

Panama Papers HQ

The Panama Papers remind us that aggressive tax avoidance is a social injustice. Exposed wealthy individuals and corporations say they did nothing wrong, equating “wrong” with “illegal.” Tax avoidance is unethical, not illegal. Tax loopholes are big enough to drive a Brinks truck through, assuming you are rich enough to own a Brinks truck in the first place. Tax dodgers are publicly shamed, not jailed. Here are 5 shameful tax avoidance numbers that amplify their shame.

Click image to enlarge

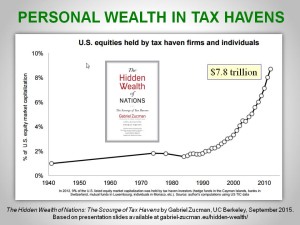

$7.6 trillion

As mentioned in one of my previous blogs, there is about $7.6 trillion (U.S.) held by rich individuals in offshore bank accounts across the world, as estimated by Gabriel Zucman in The Hidden Wealth of Nations: The Scourge of Tax Havens. A trillion dollars is a million million dollars. $1,000,000,000,000. Twelve zeros. $7.6 trillion is a staggering amount of dead money. Most of that is stashed in tax havens, protecting it from their home country’s tax men. That’s what the Panama Papers are calling out.

8%

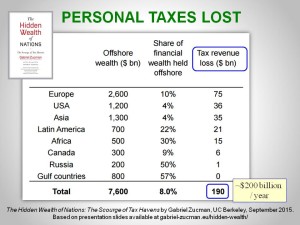

That $7.6 trillion is equivalent to about 8% of the world’s total household financial wealth, on average. The proportion of personal wealth stashed in secret tax havens varies widely by country.

- Russia: about 50%

- Africa: about 30%

- Latin America: about 20%

- Canada: about 9%, or about $300 billion

- U.S.A.: about 4%, or about $1.2 trillion

$200 billion

Click image to enlarge

So what? Zucman estimates that this leads to almost $200 billion in annual losses to government tax revenues in the individuals’ countries of residence. The U.S. share of these unpaid personal taxes is about $36 billion per year; in Europe, it is about $75 billion per year; in Canada, about $6 billion per year.

No wonder several European governments are teetering on the the brink of bankruptcy and cutting back on services and public sector employment. Tax avoiders are destroying essential social and economic infrastructure. This is not a game of hide and seek; it is a war on social justice.

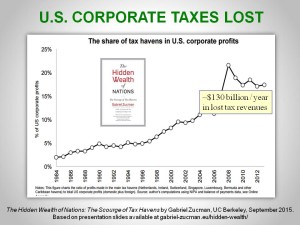

$130 billion

It is not just the 0.1% of wealthy individuals who dodge taxes; corporations are playing the tax avoidance game, too. Big time. Behind the smokescreen of their fiduciary duty to shareholders, companies have become irresponsible corporate citizens robbing local governments of the wherewithal to provide essential education, health, welfare and infrastructure services that citizens — and the companies themselves — enjoy.

Click image to enlarge

For example, by (legally) shifting their huge financial profits to tax havens, U.S. corporations deprive the American government of about $130 billion per year. The Canadian Taxpayers Federation estimates that Canadian corporations have $199 billion in sheltered assets in tax havens, costing Canadian governments $7.8 billion in lost tax revenue in 2014. This is in addition to the $6 billion of taxes avoided by very wealthy individual Canadians.

A $billion here, a $billion there … pretty soon we’re talking real money. No wonder we are running structural deficits at the federal and most provincial levels of government.

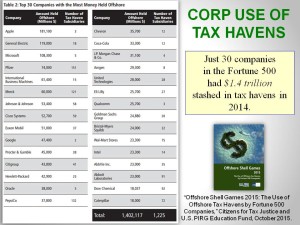

358

Click image to enlarge

It’s not just a few unethical apples that are behaving unethically. The rot has spread through the corporate barrel. Since 1990, it has gradually become the new normal. At least 358 companies, nearly 72% of the Fortune 500, operate at least 7,622 subsidiaries in tax haven jurisdictions as of the end of 2014. These subsidiaries hold $2.1 trillion in accumulated profits offshore for tax purposes. About 65% of this sum is concentrated among the top 30 companies. They are the leaders of the corporate ethical laggards.

Why do governments tolerate this behavior? Why don’t global governments get together, plug their tax loopholes, and crack down on individual and corporate offenders? Why do we continue to elect governments that refuse to act?

Bob

Please feel free to add your comments and questions using the “Leave a reply” comment box under the “Share this entry” social media symbols, below. For email subscribers, please click here to visit my site and provide feedback. Backup slides for this topic are in my Master Slide Set.