3 Weighting Factors for the Business Case for Sustainability

What if the financial business case for company action on a pressing environmental or social issue is not good enough? Even after estimating all the direct and indirect benefits with the help of the new Sustainability Advantage Ultbook, and rechecking all the data and assumptions used in its calculations, the return on investment looks disappointing. Then what? Don’t despair. Depending on how the 3 weighting factors for the business case for sustainability are applied, the sustainability initiative may still get the flashing green light from executives.

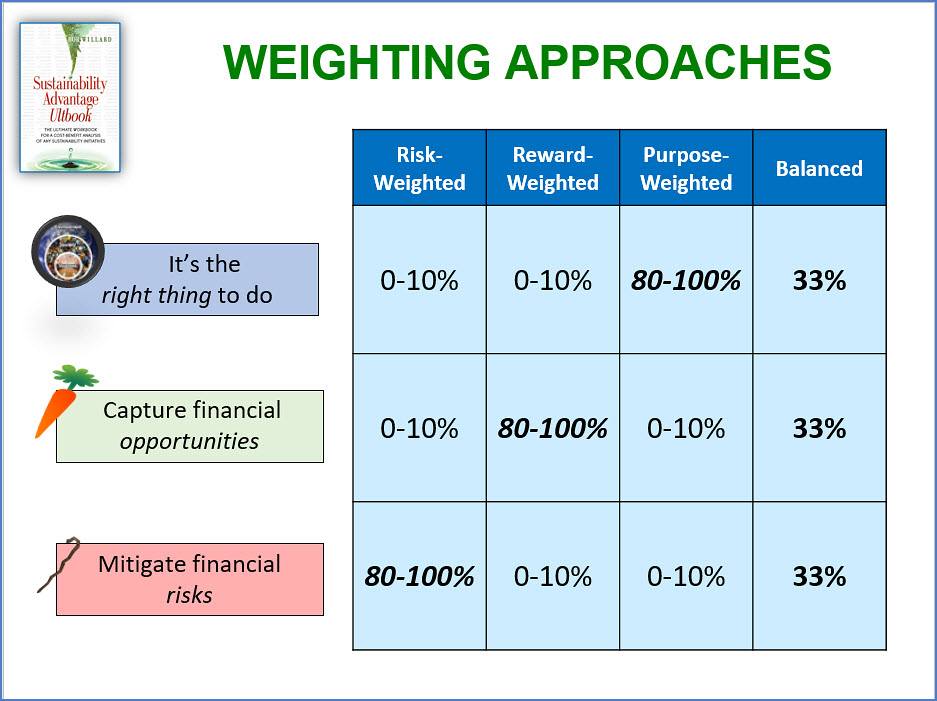

The three weighting factors are the same ones that are used for any business decision. They echo the “Big 3 Whys” described in a previous blog, which I have since renamed as the “Big 3 Justifications” in the latest draft of Ultbook. The dominant rationale for a decision depends on decision-makers’ priorities at the time of the decision. They are reflected in the column headings in the opening graphic, above.

Risk-weighted: This is the hard-nosed businesspersons’ rationale. It is a prevalent decision making mindset in corporations – in fact, it is a point of pride and is viewed as a sign of good governance. Even if the financial rewards of the initiative are weak or negative in the short term, and its activation of company purpose is fairly neutral, the company undertakes the initiative anyway because the potential downside of not doing so is not acceptable. In the high-stakes game of business, the threat of sticks is often a stronger motivator than the promise of carrots.

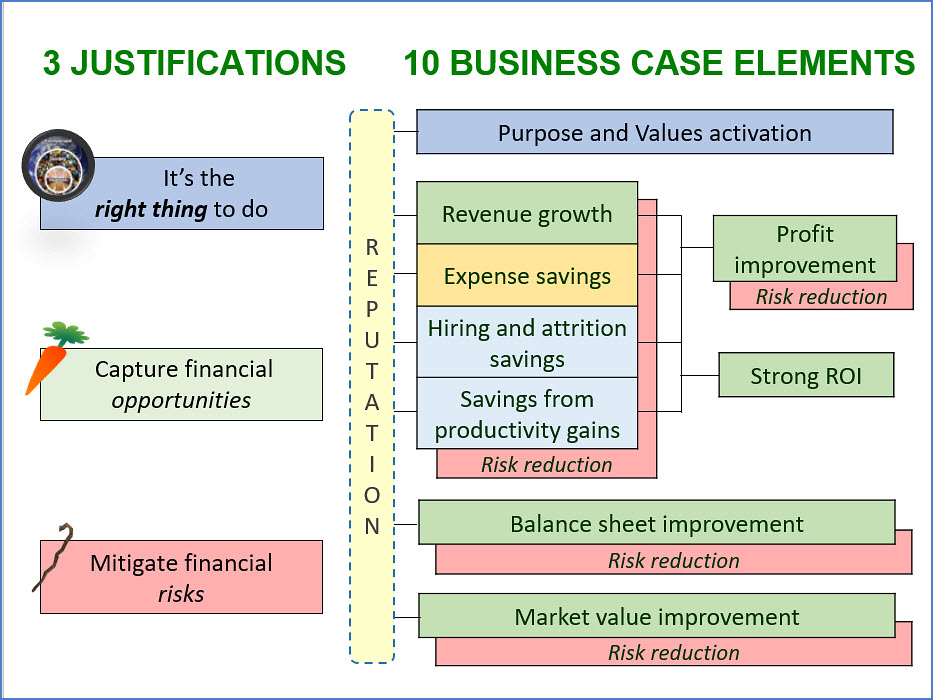

Reward-weighted: This is flip side of hard-nosed businesspersons’ risk-weighted rationale. Their sense of fiduciary duty compels them to reject the sustainability initiative if it cannot be cost justified in the short term. Period. In fact, they may be driven by a sub-element of the financial rewards, such as ROI, expense savings, top-line revenue growth, or winning the war for talent. That’s why those elements are explicitly sized in the business case for any sustainability initiative, as shown in the adjacent figure.

Purpose-weighted: For founder-owned businesses where the founder has strong ethical values that are institutionalized throughout the company, the dominant criteria may be how the sustainability initiative helps activate the purpose and values of the company. This may be the case for B Corporations, co-operatives, social enterprises, and corporations with strong values-based cultures that are no longer founder-led or founder-owned. Intangible / non-financial factors often trump tangible / financial factors. Even if the financial rewards are weak or negative in the short term, and the potential downside risks of not doing the initiative are low, the company undertakes the initiative anyway because it is simply the right thing to do.

Balanced: This looks like the “ideal” weighting approach. It may be how the result of deliberations among the executive team is communicated, although individual executives may prioritize one of the three weighting approaches at first. The balanced approach represents their collective rationale for undertaking the sustainability initiative.

So if a proposed sustainability initiative is rejected, it might be helpful to (delicately) inquire how executives weighted their decision, to avoid misunderstandings when you share their decision with your colleagues. If executives’ weighting approach prevents support for the sustainability initiative, and they are not willing to package the undertaking with more promising initiatives so that their combined business cases justify action, you should agree that the company should not undertake it (yet), and move on.

Why? Because without a compelling case for the initiative, executives will soon allow other priorities to dominate their attention. Hopeful stakeholders’ enthusiasm for the efforts will be replaced with another layer of cynicism as the initiative falters. The company’s carefully cultivated trust with employees, customers, and other stakeholders who are genuinely concerned about environmental and social issues will be eroded by another false start.

No matter how good a sustainability champion is, important sustainability initiatives languish without senior-level support sooner or later … and this may be a “later” situation. It’s a timing issue, not a sustainability champion competency issue. The company is not ready yet to seriously prioritize sustainability initiatives. That will change as the factors in the business case become more compelling, which they will … later.

In the meantime, the sustainability champion needs to make the decision that most change agents are faced with at some point: change companies or change companies. That is, they could wait for circumstances to improve the readiness factor in their current company and they can help make that happen. Or, if it looks like there is little likelihood of the weighting of the business case elements changing anytime soon, they could move on to another organization that is in a better situation … and they can use the same three weighting factors when making their more personal decision to go or stay .

Bob

Please feel free to add your comments and questions using the “Leave a reply” comment box under the “Share this entry” social media symbols, below. For email subscribers, please click here to visit my site and provide feedback. Slides used in this blog are from my Master Slide Set, to which anyone can subscribe, and from Ultbook.